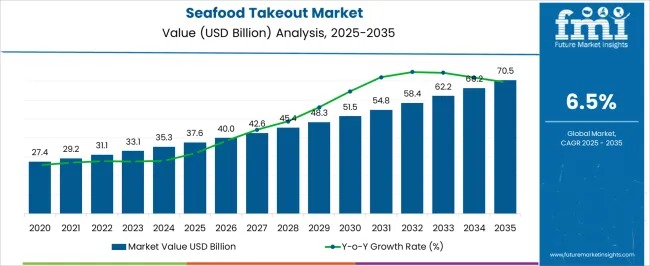

The global Seafood Takeout Market is entering a phase of accelerated, structurally supported growth as consumers increasingly prioritize convenience without compromising on nutrition and taste. Valued at USD 37.6 billion in 2025, the market is projected to reach USD 70.5 billion by 2035, expanding at a compound annual growth rate (CAGR) of 6.5% over the forecast period. This momentum reflects the convergence of urban lifestyles, rising disposable incomes, and growing acceptance of seafood as a healthy, everyday protein choice across developed and emerging economies.

Seafood takeout has evolved from a niche offering into a mainstream foodservice category. Time-constrained consumers, particularly in metropolitan regions, are opting for ready-to-eat and delivery-friendly seafood meals that align with wellness goals. The rapid scaling of online food delivery platforms, cloud kitchens, and takeaway-focused restaurant models has further widened consumer access, enabling seafood menus to reach new demographics and consumption occasions.

Get Exclusive Access To Data Tables, Market Sizing Dashboards, And Analyst Insights. Request Sample Report! https://www.futuremarketinsights.com/reports/sample/rep-gb-14995

At the same time, sustainability and sourcing transparency are becoming central to brand differentiation. Operators are increasingly emphasizing responsibly sourced seafood, streamlined cold-chain logistics, and packaging solutions that preserve freshness during transit. These shifts are reinforcing consumer trust while helping restaurants manage the operational complexities associated with perishable products.

Data Snapshot Highlights Market Trajectory

- Market value (2025): USD 37.6 billion

- Forecast value (2035): USD 70.5 billion

- Forecast CAGR (2025–2035): 6.5%

- Leading cuisine segment (2025): Chinese cuisine (21.1% share)

- Key growth regions: North America, Asia-Pacific, Europe

Chinese Cuisine Leads Product Innovation in Seafood Takeout

Within the product type landscape, Chinese cuisine is projected to command 21.1% of total revenue in 2025, making it the dominant culinary segment. Its leadership is underpinned by strong consumer familiarity, bold yet balanced flavor profiles, and cooking techniques such as stir-frying and steaming that preserve texture and taste during delivery.

Chinese seafood dishes also offer operational flexibility, allowing restaurants to adapt menus based on locally available fish and shellfish. This adaptability, combined with quick preparation times and portion customization, has made Chinese cuisine a cornerstone of urban seafood delivery ecosystems worldwide.

Quick Service Restaurants Drive Volume Growth

By restaurant type, quick service restaurants (QSRs) are expected to account for 34.6% of market revenue in 2025. Their dominance stems from standardized menus, high-throughput kitchens, and aggressive integration with digital ordering and delivery platforms.

QSR operators have invested heavily in:

- Pre-portioned seafood components to ensure consistency

- POS-to-delivery integrations to reduce order-to-door times

- Takeaway-optimized packaging that maintains temperature and quality

These efficiencies have positioned QSRs as the preferred channel for daily seafood consumption among commuters, students, and families.

Chained Foodservice Emerges as the Leading Business Model

From a business type perspective, chained foodservice operators are anticipated to capture 59.3% of total revenue in 2025. Brand recognition, centralized procurement, and scalable logistics have enabled chains to manage seafood sourcing more effectively than independent operators.

Advanced inventory forecasting, kitchen automation, and omnichannel loyalty programs are helping chains reduce waste while maximizing repeat purchases. As trust remains high in established seafood brands, chained models are expected to deepen their presence across both mature and emerging markets.

Lifestyle Shifts and Pescetarian Trends Fuel Demand

Consumer behavior is playing a decisive role in market expansion. Rising awareness of the health benefits of seafood—such as high-quality protein and omega-3 fatty acids—has accelerated adoption among health-conscious consumers and pescetarians. As concerns grow around additives and intensive livestock farming practices, seafood is increasingly viewed as a cleaner, more sustainable protein alternative.

Economic improvements and income growth, particularly in North America and Asia-Pacific, are also supporting premiumization. Consumers are trading up to higher-quality seafood dishes, including sushi, crustaceans, and chef-curated recipes, across both quick service and full-service formats.

Sustainability Challenges Shape the Competitive Narrative

Despite strong growth prospects, the market faces constraints related to overfishing and species depletion. In response, collaboration across the seafood value chain—linking fishermen, aquaculture producers, processors, and restaurants—is gaining traction. Many operators now highlight certified sustainable options such as catfish and tilapia, aligning ecological responsibility with long-term supply security.

Asia-Pacific and North America Anchor Regional Growth

North America continues to demonstrate robust demand, with an estimated 80% of total seafood catch consumed as human food, underscoring the scale of takeout and foodservice consumption. In parallel, Asia-Pacific has emerged as a global epicenter for seafood cuisine, driven by deep-rooted culinary traditions in China and India and the rapid expansion of organized foodservice outlets.

The region’s surge in online ordering, coupled with rising urbanization, is creating new revenue channels for seafood takeout providers and accelerating market formalization.

Competitive Landscape and Recent Developments

The competitive environment is marked by continuous menu innovation, strategic partnerships, and mergers and acquisitions. Leading players such as P.F. Chang’s, Sizzler, Bahama Breeze Island Grille, Rubio’s, Long John Silver’s, Red Lobster, Captain D’s Seafood Kitchen, and Bonefish Grill are expanding value-added offerings and strengthening digital engagement.

Recent developments include:

- Launch of value-added seafood products for Amazon Go stores in 2024

- Introduction of innovative frozen seafood formats with natural thawing technology

- Growing global visibility of Asian seafood cuisines, boosting takeout demand

Outlook

As convenience dining, health-driven choices, and digital food ecosystems continue to intersect, the seafood takeout market is well-positioned for resilient, long-term growth. Operators that balance sustainability, operational efficiency, and culinary innovation are expected to capture outsized value in this evolving global landscape.