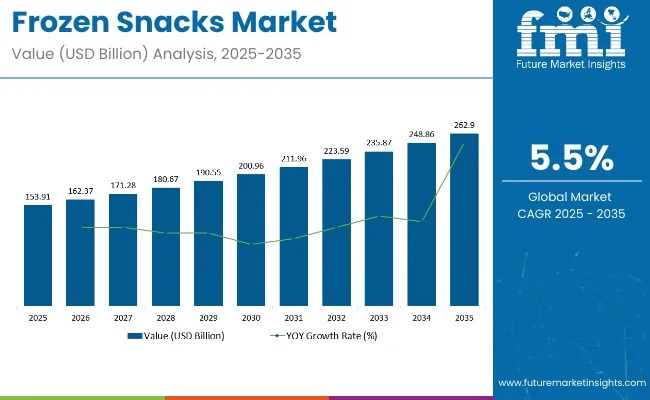

The global frozen snacks market is entering a strong growth phase, projected to expand from USD 153.91 billion in 2025 to approximately USD 262.90 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5%. This sustained momentum reflects a fundamental shift in how consumers approach meals—favoring convenience, speed, and portion-controlled indulgence in increasingly time-constrained lifestyles.

Urbanization, dual-income households, and evolving work patterns are accelerating demand for ready-to-eat and easy-to-prepare frozen snacks. Products such as frozen fries, mini pizzas, dumplings, and appetizers are no longer viewed as occasional treats but as everyday meal solutions, supported by improvements in freezing technology that preserve taste, texture, and nutritional value.

Get Exclusive Access To Data Tables, Market Sizing Dashboards, And Analyst Insights. Request Sample Report! https://www.futuremarketinsights.com/reports/sample/rep-gb-14491

Snackification and Indulgence Drive Category Expansion

One of the most influential demand drivers is the global rise of “snackification,” where consumers replace traditional meals with smaller, bite-sized options consumed throughout the day. Frozen snacks align seamlessly with this trend, offering flexibility, portion control, and indulgence without extended preparation time.

At the same time, consumers are seeking comfort and nostalgia alongside bold flavor experiences. Global cuisines, spicy profiles, and familiar classics with modern twists are reshaping product innovation strategies across the frozen food aisle. Longer shelf life and reduced food waste further enhance frozen snacks’ appeal in both retail and foodservice channels.

Strategic Moves by Key Industry Players

Leading manufacturers are actively capitalizing on these shifts. Nestlé has strengthened its frozen foods footprint by aligning with consumer preferences for indulgent yet convenient offerings. In its 2025 food trend outlook, the company highlighted themes such as global flavors, “newstalgia,” and “little treat culture,” reinforcing frozen snacks’ role as shareable and emotionally resonant food choices.

Conagra Brands has accelerated innovation by launching over 50 new frozen products, including Southern-inspired meals developed with Dolly Parton. The company’s focus on mini and bite-sized formats—such as empanadas and tacos—directly addresses rising between-meal snacking demand.

Ajinomoto Co., Inc. continues to expand frozen food offerings across Japan and Southeast Asia, leveraging the popularity of gyoza and karaage amid growing global interest in Japanese cuisine. McCain Foods, meanwhile, has introduced hybrid potato snacks with bold flavors like Firecracker Chilli, while advancing sustainability initiatives through regenerative farming partnerships.

Global Trade Dynamics Shape Market Accessibility

The frozen snacks market is supported by robust international trade flows. Countries with advanced food processing capabilities dominate exports, while high-consumption regions rely on imports to meet demand.

Major exporting countries include:

- United States – frozen pizza, fries, and appetizers

- Belgium and France – frozen potato products and pastries

- China – rapidly expanding frozen snack exports across Asia

Major importing countries include:

- United States, Germany, and the United Kingdom – strong retail and foodservice demand

- Japan and Canada – diversified imports of dumplings, fries, and ready meals

These trade dynamics are enhancing product variety and supporting year-round availability across regions.

Rising Consumer Spending Reflects Market Maturity

Per capita spending on frozen snacks continues to rise, particularly in developed markets. In North America and Western Europe, high household penetration of frozen foods and growing availability of plant-based and gluten-free options are sustaining spending growth across retail and foodservice channels.

Emerging economies such as China, India, and Brazil are witnessing faster growth rates, driven by urbanization, rising disposable incomes, and increasing adoption of Western-style frozen snacks. While per capita spending remains lower, volume growth is accelerating rapidly.

Investment Hotspots: Ready Meals and Ready-to-Eat Formats

Frozen ready meals are expected to account for 35% of total market share in 2025, supported by demand for affordable, multi-cuisine meal solutions that require minimal preparation. Leading players including Nestlé, Conagra Brands, and Tyson Foods are expanding portfolios to include both comfort foods and healthier alternatives.

The ready-to-eat category is projected to capture 40% of market share, driven by products such as frozen pizzas, sandwiches, and snack-sized meals. Improved taste profiles, enhanced nutritional formulations, and portability are strengthening this segment’s leadership position.

Challenges Balanced by Innovation-Led Opportunities

Despite positive growth, the market faces challenges related to cold-chain disruptions, rising energy costs, and increasing consumer scrutiny of sodium, preservatives, and trans fats. Sustainability concerns around packaging waste and carbon-intensive freezing processes are also shaping regulatory and corporate strategies.

However, opportunities remain significant. Growth in plant-based frozen snacks, premium gourmet offerings, and smart packaging technologies is creating new revenue streams. Innovations such as QR-enabled freshness tracking and AI-driven shelf-life monitoring are enhancing transparency and consumer trust.

Country-Wise Outlook Highlights Consistent Momentum

The United States leads growth with strong demand for clean-label, plant-based, and premium frozen snacks, supported by e-commerce and direct-to-consumer delivery models. The UK and EU markets are expanding steadily as consumers favor vegetarian, organic, and sustainably packaged frozen foods. Japan and South Korea continue to see rising demand for authentic regional snacks and fusion products, supported by advancements in quick-freezing technologies.

Competitive Outlook

Competition in the frozen snacks market is intensifying as manufacturers invest in AI-powered formulation, sustainable packaging, and nutrient-enhanced products. Companies that successfully balance indulgence, health, and convenience—while maintaining supply chain efficiency—are expected to secure long-term competitive advantage in this evolving global market.