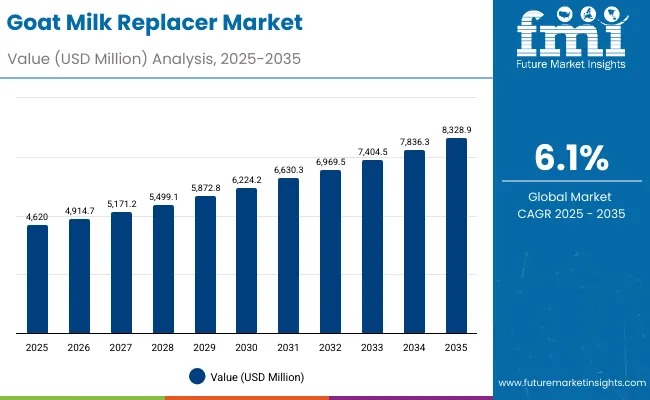

The global goat milk replacer market, valued at USD 4,620.0 million in 2025, is set to reach USD 8,328.9 million by 2035, expanding at a steady 6.1% CAGR. Growth is driven by healthcare systems prioritizing nutrition-sensitive care, pediatric digestive tolerance, and the integration of specialized feeding protocols across hospitals, clinics, and nutrition centers.

The market’s rise mirrors the increasing adoption of goat milk replacers in infant formula, pediatric care, and clinical nutrition programs, as healthcare providers shift toward high-digestibility, allergy-sensitive alternatives that offer better nutritional absorption and strong compatibility with existing feeding ecosystems.

Explore trends before investing – request a sample report today! https://www.futuremarketinsights.com/reports/sample/rep-gb-28557

Growing Preference for Nutrition-Sensitive Healthcare

With infant formula accounting for nearly 45% of consumption, goat milk replacers have become essential in pediatric environments that demand improved digestive outcomes and reliable nutritional quality. Whole milk-based replacers—representing 28% of 2025 demand—remain the preferred choice due to their complete nutritional profiles and consistent tolerance across infant and clinical feeding systems.

Key quick stats:

- 2035 Market Value: USD 8,328.9 million

- CAGR (2025–2035): 6.1%

- Leading Regions: Europe, South Asia & Pacific, North America

- Top Companies: Meyenberg Goat Milk Products, Hoegger Supply Co., Savencia Fromage & Dairy, Denkavit Group, Land O’Lakes Inc.

Why Goat Milk Replacers Are Gaining Industry-Wide Acceptance

Scientific evidence highlights goat milk’s superior digestibility, smaller fat globules, and lower allergenicity compared to traditional dairy. Its elevated levels of medium-chain fatty acids and bioactive compounds support infant development, making goat milk-based formulations especially valuable for nutrition-sensitive populations.

Technological evolution—from basic powders to advanced concentrates and ready-to-feed liquids—has enabled manufacturers to meet more complex clinical and pediatric requirements. Enhanced drying systems, protein isolation technologies, and continuous nutrient monitoring are helping brands maintain consistent quality despite natural variations in milk sources.

2025–2035 Growth Outlook: Two Distinct Phases

Between 2025 and 2030, the market will grow from USD 4,620.0 million to USD 6,224.2 million, contributing 43.3% of total forecasted decade growth. This period will be shaped by:

- Rising demand for specialized infant nutrition

- Integration with pediatric and clinical feeding programs

- Innovation in plant-based and organic formulations

From 2030 to 2035, another USD 2,104.7 million will be added as hospitals, pediatric units, and nutrition companies expand advanced infant formula systems and adopt next-generation clinical solutions. Strategic partnerships between replacer manufacturers and healthcare operators will further accelerate adoption.

Market Drivers and Restraints

Key Drivers

- Specialized infant nutrition: Goat milk replacers offer 40–60% higher digestibility compared to conventional systems.

- Government-backed nutrition programs: Countries are rolling out infant health and nutrition development incentives through 2030.

- Technological advancements: Protein processing and clinical-grade formulation improvements enhance health outcomes while reducing operational costs.

Challenges

- High formulation and validation costs

- Supply chain limitations for specialized milk sources

- Regulatory complexity in emerging markets

Country-Level Growth Insights

Growth momentum is strongest in markets investing in healthcare modernization and nutrition innovation.

- UK: 6.7% CAGR — Supported by advanced pediatric feeding systems and strong government health policies.

- India: 6.5% CAGR — Driven by clinical nutrition expansion and large-scale public health programs.

- China: 6.3% CAGR — Powered by pediatric nutrition advances and healthcare innovation hubs.

- USA: 5.8% CAGR — Demand fueled by technology-driven feeding systems and clinical nutrition upgrades.

- France: 5.2% CAGR — Emphasis on therapeutic nutrition and hospital modernization.

- Brazil: 2.6% CAGR — Growth linked to urban healthcare expansion and maternal-child nutrition programs.

Segmental Trends

By Source Type

- Whole milk-based: 28%, dominant due to complete nutrition

- Whey-based: 27%, preferred for pediatric digestibility

- Skim milk-based: 25%

- Plant-based: 20%, growing for allergen-sensitive applications

By Form

- Powder: 70% share—largest due to shelf-life and storage efficiency

- Liquid concentrate: 15%

- Ready-to-feed liquid: 15%

Competitive Landscape

The market remains moderately consolidated, with the top three companies controlling 25–35% share. Leaders such as Meyenberg Goat Milk Products and Savencia Fromage & Dairy focus on:

- Clinical-grade formulations

- Rapid validation cycles

- Deep integration with healthcare networks

Challengers like Denkavit and Land O’Lakes leverage regional presence and specialized feeding technologies, while emerging players in India and China gain ground through cost optimization and localized innovation.