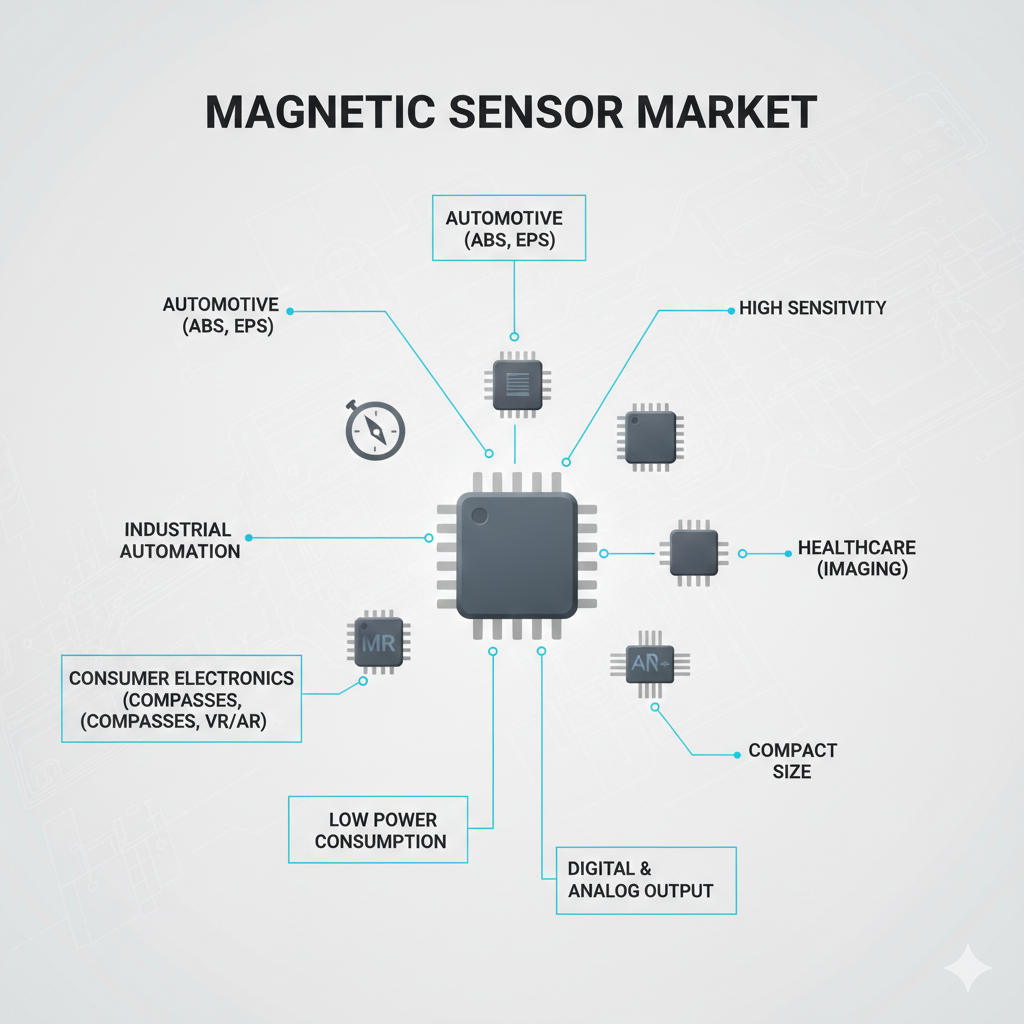

In 2026, the magnetic sensor market has moved beyond its status as a simple component industry. It is now a focal point of global semiconductor and critical mineral geopolitics. As electric vehicles (EVs) and industrial automation drive demand to new heights, the vulnerabilities of this specialized supply chain have become a board-level concern for OEMs.

Key Takeaways for 2026

- Legacy Node Bottlenecks: Magnetic sensors primarily use mature semiconductor nodes (e.g., 200mm wafers). These lines remain structurally overbooked as industrial and automotive sectors compete for limited capacity.

- Dual-Point Fragility: Sourcing risk is “double-layered.” Shortages can stem from semiconductor fab capacity or from the rare earth permanent magnets (like NdFeB) required for the sensor assemblies.

- Geopolitical Licensing Risks: 2025’s export controls on rare earths highlighted how licensing frictions in a single region can stall global automotive production within weeks.

- The “Design-In” Hedge: Strategic resilience now requires designing systems that can swap between sensor technologies (e.g., from Hall to TMR) or sourcing from newly established domestic “critical mineral corridors.”

Exhaustive Market Report: A Complete Study

https://www.futuremarketinsights.com/reports/magnetic-sensors-market

Where are the Bottlenecks Today?

Magnetic sensors are not standalone devices; they are the interface between physical motion and digital logic. This requires a complex manufacturing stack that is currently squeezed at three distinct points:

- Mature Node Semiconductor Capacity

Most Hall-effect and magnetoresistive (MR) sensors are fabricated on 200mm (8-inch) wafers using CMOS or BiCMOS processes. Unlike AI chips that chase the 3nm frontier, sensors require the reliability and voltage tolerance of older, mature nodes.

Because there has been systemic underinvestment in 200mm capacity for a decade, these fabs remain at near 100% utilization. When demand for power management or microcontrollers spikes, magnetic sensor production often faces allocation delays.

- Critical Metal Thin-Film Stacks

Advanced TMR (Tunnel Magnetoresistive) and GMR (Giant Magnetoresistive) sensors depend on thin-film stacks containing cobalt, nickel, and iron alloys. These materials are featured on nearly every “critical raw material” list. Supply volatility in cobalt, in particular, keeps the long-term cost and risk profile of high-performance sensors elevated.

- Permanent Magnet Assemblies

A magnetic sensor is useless without a magnetic field. Many automotive sensors—such as those in anti-lock braking (ABS) or electric motor rotor position sensing—require Neodymium-Iron-Boron (NdFeB) magnets.

Current Context: As of 2025, China continues to control over 90% of the processing and manufacturing of these magnets. Recent export licensing delays have turned what was once a commodity into a strategic gating factor.

How Tensions are Transforming the Risk Profile

The “chip crunch” of the early 2020s was the first warning, but 2025 provided the second shock. Following new export restrictions, US, European, and Indian trade associations warned that vehicle production could halt due to shortages of basic leakage sensors and windshield wiper motors.

This has changed the OEM mindset. Sensors are no longer “cheap commodities” but are now managed as coupled systems. A bottleneck in a $1 sensor can stop the delivery of a $60,000 EV. Consequently, “supply risk” is no longer just about the fab; it’s about the overlay between semiconductor foundries and critical mineral geopolitics.

Building Resilience: The 2026 Playbook

Suppliers and governments are moving aggressively to de-risk this chain through three main pillars:

- Geographic Diversification

Governments are now treating magnet supply as a matter of national security.

- India: The Budget 2026 recently announced four “rare-earth mineral corridors” in Odisha, Kerala, Andhra Pradesh, and Tamil Nadu to build integrated mine-to-magnet capacity.

- US/EU: Massive subsidies under the CHIPS Acts are finally bringing new analog fab capacity online, focusing specifically on the mature nodes that sensors rely on.

- Technical Substitution

Automakers are exploring “rare-earth-lean” or even “rare-earth-free” designs. While high-performance NdFeB magnets are hard to replace, some sensor architectures are being redesigned to work with weaker, more abundant ferrite magnets by using more sensitive TMR sensors.

- Design and Sourcing Discipline

For OEMs, the practical hedge is now a layered strategy:

- Mapping: Granular visibility into where every sensor’s wafer is fabbed and where its magnet is sintered.

- Dual Sourcing: Qualifying multiple fabs and, crucially, multiple regions for the same part number.

- Redesign Readiness: Maintaining a “B-design” for critical assemblies that can utilize alternative sensor technologies if the primary route is blocked.

Why Choose FMI: Empowering Decisions that Drive Real-World Outcomes: https://www.futuremarketinsights.com/why-fmi

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.