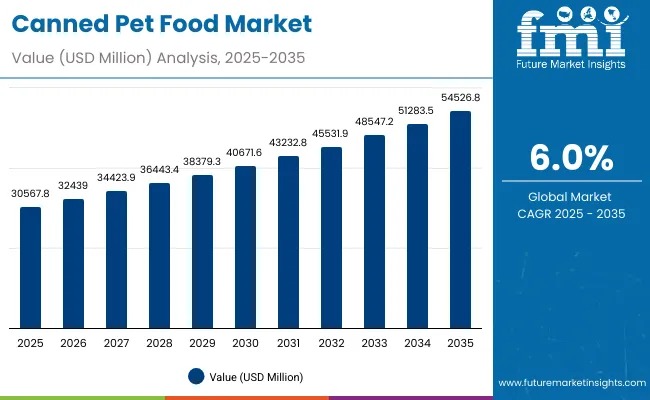

The global Canned Pet Food Market is entering a decisive decade of transformation, underpinned by rising pet humanization, advances in nutrition science, and accelerating premiumization across developed and emerging economies. The market is projected to reach USD 30,567.8 million in 2025 and expand to USD 54,526.8 million by 2035, registering a compound annual growth rate (CAGR) of 6.0%. This represents an absolute value addition of nearly USD 23,959.0 million, translating into a robust 1.8X expansion over ten years.

Growth momentum is not uniform across the decade. Between 2025 and 2030, the market is expected to rise from USD 30,567.8 million to USD 40,671.6 million, accounting for 42% of total decade growth. This phase is characterized by steady adoption of premium canned diets, grain-free recipes, and functional nutrition formats, largely driven by veterinary recommendations and growing awareness of pet wellness. Dog food continues to dominate demand during this period, supported by higher per-pet consumption and strong acceptance of meat-based formulas such as chicken and beef.

Explore trends before investing – request a sample report today! https://www.futuremarketinsights.com/reports/sample/rep-gb-26666

The second growth phase, from 2030 to 2035, is forecast to contribute 58% of total incremental value, as the market accelerates from USD 40,671.6 million to USD 54,526.8 million. This surge is driven by widespread adoption of clean-label, organic, and human-grade canned diets, alongside rapid expansion in emerging Asian markets including China, India, and South Korea. Sustainability-led innovation gains prominence, with insect-based and exotic protein formulations entering the mainstream. During this phase, cat food captures a higher share of incremental growth, supported by rising urban cat ownership in Europe and East Asia and the preference for moisture-rich diets.

Shifting Competitive and Demand Dynamics

Historically, from 2020 to 2024, the canned pet food segment expanded steadily, dominated by multinational players controlling nearly 70% of global revenue. Competitive differentiation during this period focused on palatability, nutritional science, and premium branding, while sustainability and direct-to-consumer (D2C) models played a secondary role. Entering the 2025–2035 period, the competitive advantage is shifting decisively toward science-backed nutrition, sustainability credentials, and omnichannel distribution ecosystems.

By 2035, organic, human-grade, and insect-based formulations are expected to collectively exceed 25% of global revenue, signaling a fundamental shift in product mix. Traditional leaders face rising competition from regional Asian and Latin American brands that emphasize localized protein sourcing and culturally aligned flavor profiles. In response, global vendors are increasingly adopting hybrid strategies that integrate veterinary nutrition, e-commerce subscriptions, and premium packaging innovation.

Why the Canned Pet Food Market Is Growing

The market’s expansion is anchored in the global trend of pet humanization, where owners increasingly treat pets as family members and prioritize high-quality nutrition. Advances in formulation science have positioned canned food as a premium, wellness-oriented option offering superior digestibility, enhanced palatability, and targeted health benefits. At the same time, demand for clean-label, organic, and human-grade products is reinforcing growth, particularly in North America and Europe where transparency and naturalness strongly influence purchasing decisions.

Sustainability considerations are also reshaping demand. Plant-based and insect-based canned diets are emerging as viable alternatives to conventional meat-based products, appealing to eco-conscious consumers while addressing hypoallergenic needs. Meanwhile, digitalization of sales through online retail and subscription models is expanding access, personalizing offerings, and accelerating premium adoption.

Segmental Performance Highlights

- Pet Type: Dogs account for 55.1% of market revenue in 2025, driven by higher consumption and functional diet adoption. Cats, however, are expanding faster at a 5.0% CAGR, supported by urbanization and wet food preference.

- Ingredient Type: Meat-based formulations dominate with 68.4% share, anchored by chicken and beef. Insect-based and exotic proteins are gaining traction in premium and hypoallergenic niches.

- Product Claims: Grain-free products lead with 28.4% share in 2025, while clean-label and human-grade categories are forecast to grow faster over the decade.

Regional Growth Outlook

Asia-Pacific emerges as the fastest-growing region, led by China and India at 5.2% CAGR, supported by rising pet ownership, disposable incomes, and strong online retail penetration. Europe maintains a premium-led growth trajectory, with Germany (6.8%), the UK (6.6%), and France (6.2%) driven by demand for organic, grain-free, and sustainable canned diets. North America shows steady, value-driven expansion, with the U.S. market projected to grow from USD 7,360.7 million in 2025 to USD 13,297.5 million by 2035, fueled by functional and veterinary-prescribed diets.

Competitive Landscape and Recent Developments

The market remains moderately consolidated, led by Nestlé Purina PetCare, Mars Petcare, Colgate-Palmolive, General Mills, and Simmons Pet Food. These players leverage extensive R&D capabilities, diversified brand portfolios, and global distribution networks. Innovation pipelines increasingly focus on functional nutrition, sustainability-driven packaging, and omnichannel engagement.

Recent developments highlight this shift. In February 2025, Nestlé Purina launched an innovative pyramid-shaped wet cat food with patented easy-release packaging across 15 European markets. In June 2025, Mars Petcare partnered with leading innovation platforms to accelerate sustainable pet food solutions, including novel proteins and advanced processing technologies.

Outlook

Over the next decade, the canned pet food category will evolve from a convenience-driven segment into a science-led, sustainability-aligned, and digitally distributed market. Brands that successfully balance nutrition science, transparency, and omnichannel reach will be best positioned to capture the industry’s next wave of value creation.