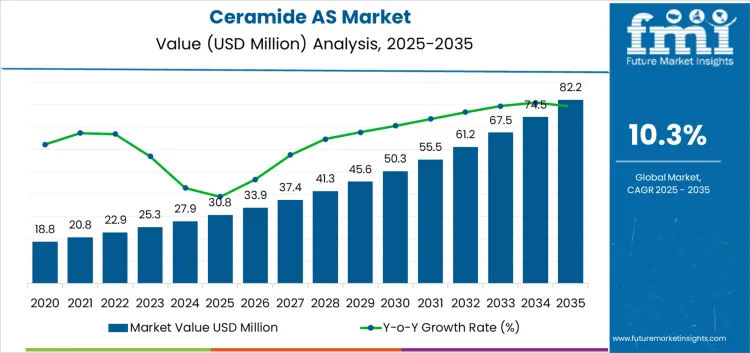

The global Ceramide AS market is projected to grow significantly from an estimated USD 30.8 million in 2025 to USD 82.2 million by 2035, reflecting a robust compound annual growth rate throughout the decade. This rapid expansion underscores the escalating importance of advanced lipid technologies in personal care, skincare, and therapeutic formulations. Fueled by heightened consumer awareness of skin barrier health and innovative ingredient delivery platforms, the Ceramide AS sector is entering a new phase of maturity and market penetration.

This wave of growth is not only powered by traditional industry leaders but also by new and emerging manufacturers eager to leverage cutting-edge technologies and expand their global footprint. As demand accelerates across Asia Pacific, Europe, and North America, manufacturers are embracing enhanced processing techniques, bio-based synthesis, and targeted formulation strategies to differentiate their offerings.

Established Leaders Pushing Boundaries

Several established players continue to anchor the Ceramide AS market with deep product portfolios, global distribution channels, and substantial R&D investments. Industry veterans such as BASF SE, Croda International, Evonik Industries, Symrise, and Dow remain at the forefront of ingredient supply, helping global brands integrate Ceramide AS into moisturizers, barrier creams, scalp treatments, and other dermatological applications.

These legacy players are increasingly focusing on scalable production capabilities and formulation support services, enabling cosmetics and dermocosmetic brands to innovate with confidence. Their expertise in formulation stability, quality control, and compliance with regulatory expectations ensures that high-performing ceramide ingredients can be deployed across diverse product categories — from premium facial care to professional skin repair regimes.

In parallel, these innovators are exploring bio-derived and sustainable production routes, which align with growing consumer demand for eco-friendly and responsibly sourced skincare ingredients. This trend is opening collaboration opportunities with biotech firms and material science startups capable of delivering fermentation-based ceramide analogues or enhanced actives optimized for sensitive skin.

New Entrants and Tech-Driven Growth

Alongside established brands, new manufacturers and technology specialists are catalyzing growth in the Ceramide AS industry. These emerging players are leveraging advancements in delivery systems, encapsulation technologies, and lipid complex engineering to create highly effective ceramide blends with improved skin bioavailability and performance.

Such innovations are especially resonant in markets where consumers seek products that offer both clinical efficacy and sensory appeal. Startups and niche ingredient innovators are partnering with beauty brands to co-develop next-generation barrier repair solutions, including targeted serums, hybrid formulations that blend ceramides with hyaluronic acid and antioxidants, and encapsulated ceramide formats that enhance penetration while preserving integrity.

This new wave of technology adoption is also influencing product form diversity — with powder concentrates, liquid dispersions, and high-active emulsions gaining traction among formulators striving for bespoke sensory experiences. These alternative formats provide greater flexibility for brands to innovate across daily care, anti-aging, and sensitive-skin segments, allowing even smaller manufacturers to compete with established incumbents.

To access the complete data tables and in-depth insights, request a sample report here

Expanding Global Demand and Business Opportunities

The rising consumer emphasis on hydration, barrier protection, and environmental stress defense is reshaping product development priorities for skincare and personal care categories worldwide. From dry-skin moisturizers and scalp repair treatments to advanced dermocosmetics recommended by dermatologists, the applications for Ceramide AS are broadening rapidly.

Market expansion is particularly pronounced in emerging regions, where increased retail penetration and digital commerce are introducing ceramide-rich products to a broader audience. Brands that adeptly navigate local preferences while leveraging global formulation expertise are securing meaningful traction in these growth corridors.

At the same time, manufacturers are responding to industry challenges — including the relatively higher formulation cost of ceramide actives and the need for technical rigor in processing and storage. Through strategic partnerships, enhanced supply chain integration, and focused innovation pipelines, both established and new players are overcoming these hurdles to deliver reliable, cost-effective ingredients at scale.

Collaboration and Competitive Landscape

The competitive landscape in the Ceramide AS market reflects a blend of heritage and innovation. Major suppliers maintain comprehensive ingredient catalogs and robust quality standards, while emerging firms push the envelope with niche technologies and specialized solutions tailored to sophisticated consumer demands.

This mix fosters an environment ripe for collaboration and co-creation, where brand manufacturers can draw on the strengths of material scientists, biotech innovators, and formulation experts to develop compelling products that resonate with discerning consumers.

Looking Ahead

As the Ceramide AS market charts a strong growth trajectory through 2035, stakeholders across the value chain are aligned in their pursuit of differentiation, performance, and sustainability. From global conglomerates with decades of market leadership to nimble startups introducing breakthrough technologies, the ecosystem is poised for continued evolution and opportunity.

For brands and manufacturers ready to expand their businesses, this era presents not just growing demand, but a rich landscape for technological innovation, strategic partnerships, and market leadership in skin health and personal care science.