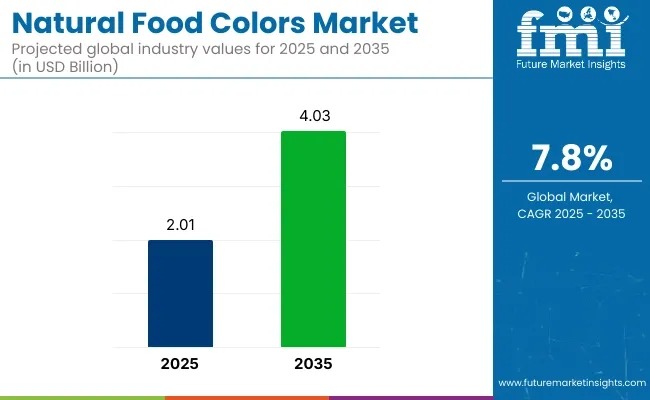

The global natural food colors market is entering a decisive growth phase as food manufacturers worldwide accelerate the shift away from synthetic dyes. Valued at USD 2.01 billion in 2025, the market is projected to nearly double to USD 4.03 billion by 2035, expanding at a compound annual growth rate (CAGR) of 7.2% over the forecast period. Rising consumer scrutiny of ingredient labels, the surge in plant-based and organic foods, and tightening regulations against petroleum-derived additives are collectively reshaping color formulation strategies across the food and beverage industry.

Explore trends before investing – request a sample report today!

Natural food colors have moved firmly from niche applications into mainstream packaged foods. Their adoption now spans beverages, dairy, bakery, confectionery, savory snacks, and functional foods, where visual appeal is increasingly linked to perceived health and transparency. Unlike synthetic dyes, natural pigments derived from fruits, vegetables, algae, and spices align with clean-label narratives and support brand trust in premium and mass-market categories alike.

Market Momentum Backed by Data and Consumption Trends

Despite rapid adoption, global per-capita consumption of natural color extracts remains relatively modest, averaging 17–20 grams per person in 2024. This signals significant headroom for growth as synthetics continue to lose favor. According to industry estimates, worldwide per-capita demand is expected to approach 21 grams by 2030, driven largely by beverages and plant-based meat alternatives where vivid hues act as visual proof points of natural formulation.

Regional disparities remain pronounced. Western Europe stands out as the most color-intensive market, supported by strict labeling laws and high packaged-food penetration. The Netherlands leads globally, consuming roughly 0.40 kg per capita in 2024 due to its role as a blending and re-export hub. Germany and Denmark follow, buoyed by bakery, confectionery, and dairy launches that specify “plant-based color only.” Importantly, regulatory assessments confirm that current consumption levels remain well below acceptable daily intake thresholds, leaving room for further expansion.

In contrast, the United States recorded per-capita usage of just under 23 grams in 2024, yet nearly matched Western Europe in spending. This reflects the premium pricing of high-purity pigments such as spirulina blue, carmine alternatives, and oil-soluble carotene dispersions used in energy drinks, sports nutrition, and plant-based meats. Canada trails slightly at around 15 grams per capita but is accelerating as major retailers commit to phasing out synthetic dyes by 2027.

Asia presents the strongest long-term upside. Average per-capita usage remains below 10 grams, but countries such as Vietnam and Thailand are rapidly scaling adoption as multinational beverage companies install natural-only production lines. India, still below 10 grams per capita, is emerging as both a production and consumption hub by expanding domestic extraction of marigold lutein and beet anthocyanins.

Carotenoids and Beverages Anchor Market Leadership

By pigment type, carotenoids are projected to dominate with a 35.8% market share in 2025. Derived from sources such as carrots, marigolds, algae, and fruits, carotenoids offer vibrant yellow-to-red hues alongside antioxidant positioning. Their versatility across dairy, snacks, bakery, and beverages ensures sustained demand, particularly as consumers increasingly associate color with functional benefits.

The beverage segment is expected to remain the leading application, accounting for 38.8% of market share in 2025. Natural colors from turmeric, saffron, spirulina, and fruit concentrates are becoming standard in juices, functional drinks, and flavored waters as brands reformulate to meet clean-label expectations without compromising shelf appeal.

India Emerges as the Fastest-Growing Market

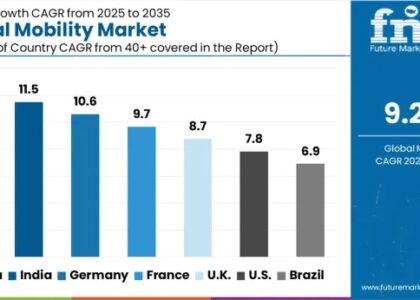

Among major countries, India is forecast to register the fastest growth at an 8.3% CAGR through 2035. Government-backed initiatives, including Make in India and Ayush programs, are supporting turmeric-curcumin clusters, marigold processing zones, and SME-scale extraction hubs. Combined with low-cost botanical sourcing and rising export demand from Europe, India is positioned to evolve from a net exporter to a high-growth consumer market over the next decade.

The United States will continue to lead in absolute dollar sales, supported by advanced encapsulation technologies, strong clean-label adoption, and regulatory pressure to reformulate children’s and mass-market foods. Germany, France, and China follow closely, each leveraging a mix of biotech innovation, functional beverages, and government-led reformulation efforts.

Competitive Landscape and Strategic Shifts

The natural food colors market remains moderately fragmented but is steadily consolidating. Chr. Hansen Holding A/S leads with an estimated 16% global market share, supported by innovations such as FruitMax® Yellow 1000 and a strong global distribution footprint. Other key players, including Sensient Technologies, ADM, GNT, Symrise, and Kalsec, are investing heavily in pigment stabilization, microencapsulation, and fermentation-based production to overcome traditional challenges related to heat, light, and pH sensitivity.

Recent strategic moves—including acquisitions, capacity expansions, and partnerships—underscore the industry’s pivot toward scalable, high-purity natural alternatives. While challenges remain around raw-material seasonality and formulation costs, ongoing R&D and regulatory tailwinds continue to strengthen the market’s long-term outlook.

As clean-label expectations harden into regulatory and retail requirements, natural food colors are no longer optional enhancements—they are becoming a core formulation standard across global food systems.