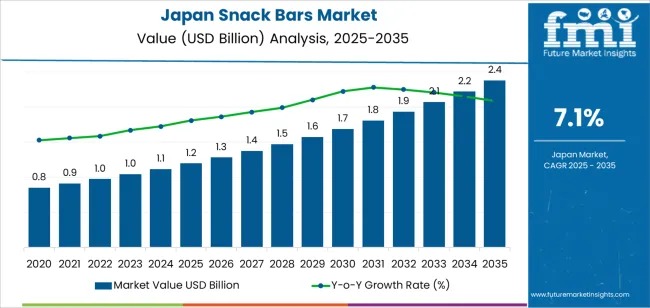

The Japan snack bars market, valued at USD 1.2 billion in 2025, is projected to reach USD 2.4 billion by 2035, expanding at a 7.1% CAGR. Growth is accelerating as consumers shift toward convenient, portion-controlled, and nutrient-dense snacking options aligned with busier lifestyles and rising health consciousness.

Growing adoption of snack bars stems from increased interest in balanced macronutrient profiles, added fibre, plant-based formulations, and on-the-go eating patterns. With expanding retail visibility across supermarkets, convenience stores, and e-commerce platforms, manufacturers are intensifying innovation cycles to cater to evolving taste and nutrition expectations.

Explore trends before investing – request a sample report today! https://www.futuremarketinsights.com/reports/sample/rep-gb-28989

Protein & Energy Bars Dominate Japan’s Snack Bar Landscape

Protein and energy bars command the largest share of the category, supported by demand for functional, fitness-linked snacks suited for pre- and post-workout routines. Improved texture formats, clean-label ingredient lists, and wider use of natural sweeteners continue to boost repeat purchases. Formulations featuring nuts, grains, and fortified micronutrients are reshaping the mainstream and specialty nutrition segments.

Key Insights (2025–2035):

- Market Value: USD 1.2 Bn (2025) → USD 2.4 Bn (2035)

- Forecast CAGR: 7.1%

- Leading Product Type: Protein & Energy Bars

- High-Growth Regions: Kyushu & Okinawa, Kanto, Kinki

Market Momentum: Early Expansion (2025–2029) to Mature Uptake (2030–2035)

Between 2025 and 2029, momentum is driven by rapid product diversification and increased procurement across supermarkets, drugstores, and digital channels. Broader adoption of fibre-rich, protein-focused, and reduced-sugar bars supports early-stage uplift.

From 2030 onward, growth stabilises as product categories mature. Incremental gains are shaped by fortified variants, digestive-health blends, shelf-life improvements, and low-sugar formulations. Corporate wellness programmes, travel retail, and lifestyle nutrition channels maintain consistent demand, highlighting a transition from innovation-led growth to routine consumption.

Demand Drivers: Health, Convenience, and Urban Lifestyle Shifts

Japan’s preference for portable, nutrient-dense snacks is strengthening snack-bar uptake. Consumers increasingly choose bars that offer protein, fibre, and functional ingredients suitable for commuting, work breaks, and fitness routines.

Demand Accelerators:

- Expansion in convenience stores, supermarkets, vending networks, and e-commerce.

- Premium, small-portion formats that suit breakfast-on-the-go.

- Rising adoption of cleaner-label and plant-based ingredient blends.

However, competition from traditional snacks, premium pricing constraints, and Japan’s long-term population decline present structural challenges for volume expansion.

Product-Type Performance: Protein Bars Lead with 45.2% Share

Protein and energy bars account for 45.2% of national demand, followed by:

- Breakfast Bars: 26.2%

- Granola & Muesli Bars: 12.4%

- Fruit Bars: 9.2%

- Other Formats: 7.0%

The segmentation reflects consumer focus on satiety, fibre intake, and balanced, convenient nutrition suited for work, school, and active lifestyle routines.

Distribution Landscape: Supermarkets Lead with 58.9% Share

Supermarkets and hypermarkets contribute 58.9% of total sales, supported by wide assortments and stable price visibility. Convenience stores account for 21.1%, capturing impulse and commute-driven purchases. E-commerce holds 20.0%, growing steadily due to subscription models and availability of imported and specialty bars.

Regional Outlook: Kyushu & Okinawa Lead Growth at 8.9% CAGR

Regional demand is shaped by urban density, retail penetration, and lifestyle patterns.

- Kyushu & Okinawa (8.9% CAGR): Strong fitness participation, tourism activity, and supermarket promotions drive uptake.

- Kanto (8.2% CAGR): Represents the largest consumer base with strong corporate, fitness, and e-commerce ecosystem integration.

- Kinki (7.2% CAGR): Driven by lifestyle-food adoption, regional flavours, and multipack family consumption.

- Chubu (6.3% CAGR): Urban retail expansion and active outdoor culture support demand for energy-dense bars.

- Tohoku (5.6% CAGR): Growing health-food awareness and supermarket penetration boost visibility.

- Rest of Japan (5.3% CAGR): Rising online purchases and growing interest in plant-based bars fuel moderate growth.

Competitive Landscape: Global Leaders Shape Japan’s Snack Bar Demand

The market is defined by strong participation from global food manufacturers with well-established cereal, granola, and protein-bar portfolios.

Leading Companies:

- General Mills

- Kellanova

- WEETABIX

- The Quaker Oats Company

- Mondelez International Group

General Mills leads with an estimated 45.1% share, supported by texture stability, ingredient consistency, and robust multi-channel distribution. Competitors such as Kellanova, WEETABIX, and Quaker Oats strengthen their positions with fortified, fibre-rich, and oat-based offerings. Mondelez International adds depth via chocolate-forward and functional bar innovations.