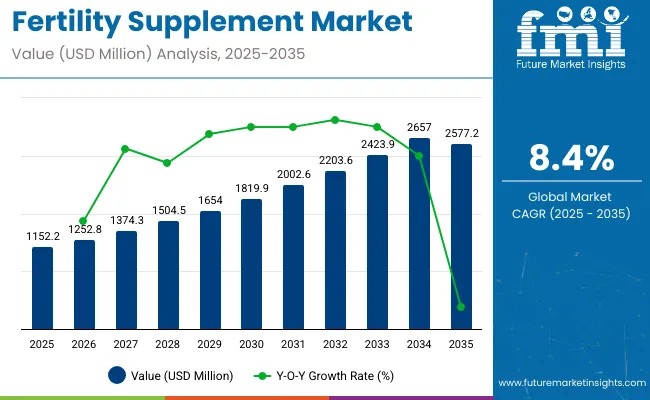

The global fertility supplement industry is estimated to be worth USD 1,152.2 million in 2025 and is projected to reach USD 2,577.2 million by 2035, expanding at a CAGR of 8.4% during the assessment period. Growth is fueled by rising awareness of reproductive health, delayed parenthood, and strong consumer preference for natural, functional, and clinically validated ingredients.

Growing research around vitamins, minerals, antioxidants, and botanical extracts is reshaping product formulation strategies. Manufacturers are strengthening their R&D capabilities to enhance consumer trust, improve clinical reliability, and introduce formulations specifically targeting hormonal balance and gamete quality. Popular ingredients include folic acid, zinc, omega-3 fatty acids, and antioxidants—each proven to support reproductive health and overall fertility outcomes.

Explore trends before investing – request a sample report today! https://www.futuremarketinsights.com/reports/sample/rep-gb-11081

Innovation in Delivery Formats and Personalized Nutrition

Manufacturers are increasingly diversifying delivery formats—from traditional capsules to more convenient gummies and powders—to increase compliance among consumers in preconception planning. Personalization is emerging as a defining shift, with companies designing nutritional regimens based on health profiles, lifestyle patterns, and diagnosed fertility-related challenges. This shift from generic to customized supplementation is driving higher adoption rates.

Growing knowledge of reproductive wellness and the availability of scientifically supported products continue to reinforce market expansion worldwide.

Rising Per-Capita Spending on Reproductive Health Supplements

Per-capita spending is climbing steadily as individuals and couples seek non-invasive, supportive approaches to reproductive health management.

Developed markets such as the U.S., Western Europe, and East Asia lead global spending due to strong online health platforms, preconception wellness programs, and widespread access to premium brands.

Emerging economies, including India, Brazil, and South Africa, are registering rapid uptake driven by urbanization, improved healthcare access, and increased awareness of fertility challenges.

Regulatory Oversight Strengthening Consumer Confidence

Governments continue to enforce stringent product safety, labeling standards, and manufacturing compliance. Agencies such as the U.S. FDA, EFSA, and FSSAI mandate accurate ingredient disclosures, dosage transparency, and restrictions on unverified therapeutic claims. Many brands now pursue GMP, ISO 22000, and third-party testing certifications to demonstrate integrity and ensure global competitiveness.

Key Consumer & Industry Trends

Growing Shift Toward Organic & Clean-Label Formulations

Brands like Garden of Life and Fairhaven Health are prioritizing whole-food, organic, and non-synthetic ingredients. Consumers increasingly prefer supplements free from GMOs, artificial additives, and chemical components.

Rising Demand for Targeted Women’s Fertility Formulas

Premama and Fertility Blend are focusing on female-centric supplements enriched with folic acid, vitamin D, omega fatty acids, and botanicals such as chasteberry and maca root. These formulations support ovulation, hormone regulation, and egg quality.

Increasing Interest in Male Fertility Solutions

Male fertility supplements are gaining traction as awareness grows regarding sperm health’s contribution to conception. Brands like Life Extension and Zahler use formulations containing zinc, selenium, CoQ10, maca, and ashwagandha to improve sperm count, motility, and hormonal balance.

Market Evolution: 2020–2024 vs. 2025–2035 Outlook

From 2020 to 2024, industry growth at 7.8% CAGR was driven by personalized nutrition and lifestyle-based fertility products. Looking ahead, the market is expected to accelerate to 8.4% CAGR through 2035, supported by:

- Digital fertility tracking platforms

- Healthcare partnership-driven product validation

- Sustainability and eco-friendly packaging

- Rising plant-based and vegan formulations

- Stronger clinical evidence and wider awareness campaigns

Market Structure: Tiered Competitive Landscape

Tier 1: Fairhaven Health, Garden of Life, and Zahler dominate with wide product portfolios, clinical validation, and strong retail footprints. Their credibility among healthcare professionals ensures deep consumer trust.

Tier 2: Brands like Premama and Fertility Blend focus on innovation, niche positioning, and targeted solutions for menstrual cycle regulation, hormonal health, or male reproductive wellness.

Tier 3: New entrants such as Mamma Chia and NutraBlast focus on organic, plant-derived, and specialty formulations. Their agility and digital-first approach help them attract younger, informed consumers.

Country Highlights

United States

The U.S. is expected to grow at 8.6% CAGR, driven by strict consumer scrutiny over ingredient origins, manufacturing transparency, and clean-label formulations. Increasing preference for non-GMO, plant-based supplements and sustainable sourcing is reshaping product development.

China

Chinese manufacturers are gaining traction with supplements incorporating Traditional Chinese Medicine (TCM) herbs such as Dong Quai, Goji berry, and Poria. Their global demand is rising due to holistic wellness trends and the expansion of cross-border e-commerce.

Japan

Japan’s fertility supplement consumption is rising due to national policies encouraging childbearing. Increased financial incentives, childcare subsidies, and workplace reforms are reshaping family planning behavior, indirectly boosting supplement adoption.

Category Insights

Vitamins & Minerals Lead Product Demand

This segment is projected to hold nearly half of the market share in 2025, supported by strong scientific validation and consumer trust in nutrient-based fertility support.

Tablets Dominate Form Adoption

Tablets are expected to account for over one-third of global sales in 2025, driven by convenient dosing, stability, and suitability for multinutrient formulations.

Competitive Developments

- Mankind Pharma’s 2024 acquisition of Bharat Serums and Vaccines strengthens its fertility therapeutics footprint.

- Beli’s 2024 expansion into fertility testing and data-driven supplements highlights the rise of integrated fertility solutions.

Leading brands include Garden of Life, Thorne Research, Fertility Nutraceuticals, Nature’s Way, New Chapter, Vitafusion, Zahler, MediNatura, Carlyle, and others.