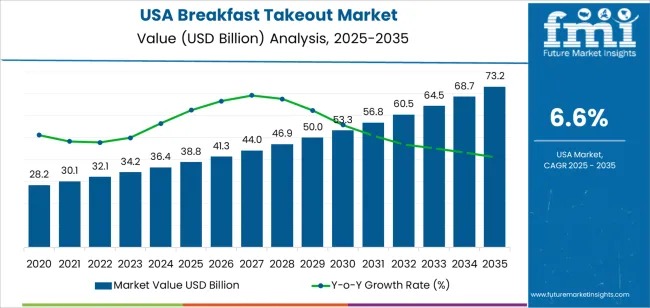

The demand for breakfast takeout in the USA is projected to grow from USD 38.8 billion in 2025 to USD 73.2 billion by 2035, expanding at a CAGR of 6.6%, according to new market insights. The sharp rise in morning takeout consumption highlights shifting consumer patterns, driven by busier routines, expanding delivery ecosystems, and increasing preference for convenient, ready-to-eat breakfast solutions.

Breakfast takeout—ranging from coffee and sandwiches to smoothies, pastries, breakfast bowls, and wraps—has become an integral component of modern, mobile lifestyles. Digital ordering platforms, QSR expansions, and a growing focus on healthier, customizable morning options continue to transform breakfast habits across the nation.

Explore trends before investing – request a sample report today! https://www.futuremarketinsights.com/reports/sample/rep-gb-29066

Market Snapshot: U.S. Breakfast Takeout Demand

- 2025 Market Value: USD 38.8 billion

- 2035 Forecast Value: USD 73.2 billion

- Forecast CAGR (2025–2035): 6.6%

- Leading Nature: Non-vegetarian (45%)

- Top Regional Growth: West (7.5% CAGR), South (6.8%)

- Top Players: McDonald’s, Starbucks, Dunkin’, Tim Hortons, Subway

- Last updated: 28 Nov 2025

Forecast Outlook: Growth Momentum Through 2035

Between 2025 and 2030, market value will rise from USD 38.8 billion to USD 53.3 billion, adding USD 14.5 billion. This expansion is supported by mass adoption of mobile ordering, expansion of QSR breakfast menus, and rapid consumer shift toward convenient morning meal choices.

From 2030 to 2035, the industry will add an even larger USD 19.9 billion, reaching USD 73.2 billion. Growth will mature but remain steady as technology, personalization, and nutritional innovation anchor breakfast takeout as a mainstream foodservice segment.

What Is Driving U.S. Breakfast Takeout Demand?

A combination of structural and behavioral factors is pushing demand upward:

- Busy lifestyles and commuter behavior fueling interest in ready-to-eat meals

- High dependency on coffee shops and QSR chains

- Expansion of app-based pickup, delivery, curbside, and drive-thru ordering

- Strong growth in protein-rich, healthier, and plant-based breakfast offerings

- Increasing innovation in portable packaging and customizable menu items

The broader breakfast takeout sector—including all foodservice formats—is valued at USD 109.6 billion in 2025 and projected to reach USD 213.7 billion by 2035, reflecting a CAGR of 6.9%.

Market Insights: Nature & Breakfast Type

Non-Vegetarian Leads with 45% Share

Non-vegetarian breakfast items—such as breakfast sandwiches, egg-meat combinations, and burritos—dominate U.S. morning takeout. Their popularity stems from:

- High consumer preference for protein-rich, filling morning meals

- Traditional American breakfast habits

- Strong satisfaction and variety in taste profiles

This category is expected to maintain leadership as time-pressed consumers prioritize fast, energizing options.

Continental Breakfast Captures 28.7% Demand

Lighter choices such as pastries, yogurt, fruits, breads, and coffee are the preferred takeout items for many urban consumers.

Demand is driven by:

- Preference for light, nutritious morning starts

- Growing health orientation

- Quick, portable formats ideal for commuting

Key Market Dynamics

Primary Growth Drivers

- Surge in mobile ordering and AI-enabled foodservice recommendations

- QSR and café chains expanding breakfast hours and menu innovations

- Rising urban workforce participation and evolving commuter lifestyles

- Consumer shift toward healthier, low-sugar, protein-rich, and plant-forward breakfast formats

Key Restraints

- Rising ingredient and labor costs impacting provider margins

- Consumer spending sensitivity during economic slowdowns

- Competition from grocery breakfast solutions and at-home meal preparation

- Pressure from dine-in alternatives and meal-prep kits

Regional Outlook: Where Is Growth Strongest?

West (7.5% CAGR) – Fastest Growth

The West, led by states like California, shows the strongest growth due to:

- A fast-paced lifestyle

- High café and QSR density

- Strong demand for healthy options like smoothies and bowls

- Widespread mobile ordering adoption

South (6.8% CAGR) – Expanding Urbanization

Growth in the South is fueled by:

- Rapid urbanization

- Rising number of professionals seeking quick morning meals

- Increasing popularity of modern, takeout-friendly breakfast formats

Northeast (6.0% CAGR) – Urban Momentum

The Northeast’s high commuter population and coffee-centric culture continue to support demand for portable, nutritious breakfast choices.

Midwest (5.2% CAGR) – Gradual but Steady

The Midwest is slower to shift from traditional habits but is gaining momentum via urban centers and expanding delivery availability.

Competitive Landscape

Major players shaping the U.S. breakfast takeout market include:

- McDonald’s Corporation (28.2% market share)

- Starbucks Corporation

- Dunkin’ (Inspire Brands)

- Tim Hortons (Restaurant Brands International)

- Subway

Competition centers on menu innovation, digital convenience, pricing, loyalty programs, and expansion of drive-thru and early-morning services. With breakfast now a high-priority daypart, leading chains are intensifying efforts to capture commuter and mobile-first consumers.