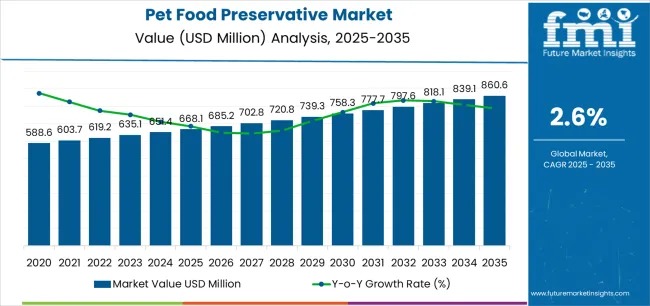

The global Pet Food Preservative Market is set to expand steadily, estimated at USD 668.1 million in 2025 and projected to reach USD 860.6 million by 2035, growing at a CAGR of 2.6% over the forecast period. Increasing pet ownership, rising awareness of food safety, and demand for extended shelf life are driving the adoption of preservatives in pet food formulations worldwide.

Stay Ahead With Data-Backed Decisions. Gain Preview Access to Methodology, Sample Charts, and Key Findings by Requesting Your Sample Report: https://www.futuremarketinsights.com/reports/sample/rep-gb-19358

Regional Insights: North America Leads the Market

North America emerges as the key growth region, accounting for a major share of the market. The United States is at the forefront, with a robust CAGR of 13.2%, driven by the country’s mammoth pet population and the rising demand for high-quality dog and cat food. Manufacturers are focusing on innovative preservative solutions that ensure safety, freshness, and nutritional integrity, meeting the expectations of modern-day pet owners.

Asia-Pacific and Europe follow closely, with China projected to grow at 12.8% CAGR due to increasing demand for natural and premium pet foods, while Germany’s biotechnological innovations in preservative formulations support a 9.6% CAGR. Japan, with its cultural affinity toward pets, and Australia & New Zealand, as exporters of premium pet food, contribute to sustained regional growth.

Nisin Maintains Dominance Among Product Types

Among preservatives, Nisin leads the market with a 24.7% share in 2025. Its natural antimicrobial properties effectively inhibit spoilage bacteria, maintaining product safety without compromising flavor or nutritional quality. Nisin’s compatibility across dry, wet, and semi-moist formulations and regulatory approval as a safe preservative reinforce its widespread adoption.

Dog Food Drives End-Use Segment Growth

The dog food segment is the largest end-use application, contributing 57.3% of market revenue in 2025. Increasing dog ownership and consumer focus on pet nutrition and health propel demand for preservatives that ensure microbial safety, consistent nutrient retention, and extended shelf life. Manufacturers are leveraging advanced preservatives to meet both safety standards and consumer preferences for natural ingredients.

Powder Form Leads in Preservative Formulations

The powder form of pet food preservatives dominates with 52.8% market share, favored for its ease of incorporation into dry foods, superior stability, cost-effectiveness, and uniform distribution within food matrices. Powdered preservatives allow manufacturers to extend shelf life while maintaining product quality and handling efficiency.

Key Growth Drivers

• Rising preference for premium, organic, and clean-label pet food.

• Expansion of e-commerce and pet food delivery channels.

• Urbanization and busy lifestyles increasing demand for safe, convenient pet food.

• Stringent regulatory standards for pet food safety and quality.

Market Moderation Factors

• Alternative preservation methods such as refrigeration and freezing.

• Consumer concerns over potential health risks of synthetic preservatives.

• Limited availability and higher costs of natural preservatives.

• Negative media coverage affecting consumer perception.

Strategic Industry Opportunities

Manufacturers are investing in R&D to develop innovative formulations and partnering with natural preservative suppliers to ensure consistent quality. Awareness campaigns emphasizing safety, efficacy, and nutritional benefits are helping build consumer trust and drive adoption.

Competitive Landscape

Leading players in the global pet food preservative market include:

BASF SE, Cargill, Kemin Industries, DSM, E.I. DuPont de Nemours, Trouw Nutrition, Kerry Inc., Altrafine Gums, PFIAA, Caldic B.V., Camlin Fine Sciences, Balchem Inc., Bentoli, Denes Natural Pet Care, PetCoach, and Bill Barr & Company.

Recent Industry Developments

• Coop Italia (Feb 2025): Launched 200+ new pet food SKUs featuring high-quality ingredients and insect protein.

• Corbion (Sep 2025): Introduced AlgaPrimeTM DHA P3 for sustainable pet nutrition.

• Bully Max (Nov 2025): Unveiled TruMune-enhanced puppy food for gut health and nutrient preservation.

With North America leading the market, growing emphasis on natural preservatives, and continuous product innovation, the pet food preservative industry is poised for steady, data-driven growth through 2035.