According to the latest insights from Future Market Insights (FMI), the global pelargonic acid market is set for strong expansion, climbing from USD 222.2 million in 2025 to USD 441.2 million by 2035, at a compound annual growth rate (CAGR) of 7.1%.

This growth reflects accelerating adoption of bio-based herbicides, antimicrobial coatings, lubricants, and specialty surfactants, as industries worldwide transition toward sustainable and biodegradable chemistry.

Sustainability and Regulatory Alignment Drive Demand

Pelargonic acid—also known as nonanoic acid—has become a cornerstone of eco-friendly industrial and agricultural formulations. Rising global pressure to replace conventional synthetic chemicals is reshaping procurement trends across Asia-Pacific (APAC), Europe, North America, and the Gulf region.

FMI’s analysis shows that over 68% of current supply is derived from renewable feedstocks, underscoring a structural shift toward greener sourcing.

The compound’s biodegradability, non-residual nature, and compliance with REACH (EU) and EPA (US) standards make it a preferred choice in markets where environmental credentials directly influence purchasing decisions.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates: https://www.futuremarketinsights.com/reports/sample/rep-gb-23094

Key Market Metrics

| Metric | 2025 Estimate | 2035 Forecast | CAGR (2025–2035) |

| Global Market Value | USD 222.2 Million | USD 441.2 Million | 7.1% |

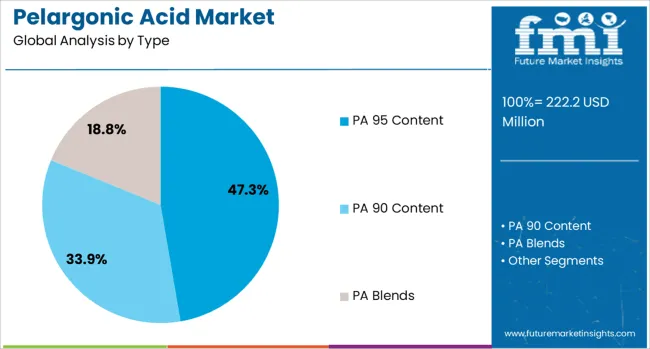

| Leading Segment | PA 95 Content (47.3%) | — | — |

| Top Application | Herbicides & Pesticides (52.1%) | — | — |

The market is forecast to generate an absolute dollar opportunity of USD 219 million between 2025 and 2035, with the second half of the decade contributing nearly 58.5% of total value growth as commercial validation of high-volume formulations accelerates.

Segment Insights

- PA 95 Content Leads by Type (47.3% Share)

High-purity PA 95 content remains the backbone of industrial and agricultural applications. Its superior efficacy, purity compliance, and environmental safety have positioned it as the preferred formulation base in modern herbicide and lubricant systems. - Synthetic Grade Dominates (63.8% Share)

Synthetic grade pelargonic acid continues to outperform due to scalable production and consistent quality, vital for large-volume users in agrochemicals and specialty chemicals. Manufacturers are refining synthetic routes to minimize waste and improve energy efficiency, aligning with global decarbonization goals. - Herbicides & Pesticides Lead Applications (52.1% Share)

Agriculture remains the largest consumer segment. Pelargonic acid’s non-residual weed control and organic certification compatibility have accelerated its use in both conventional and organic farming. Its inclusion in over 40% of organic non-selective herbicides underscores its growing agronomic relevance.

Regional Outlook: Four Power Regions Steer Global Expansion

Asia-Pacific (APAC): Innovation and Scale

APAC commands more than one-third of global pelargonic acid production, supported by abundant renewable feedstocks and rapid industrialization.

- China leads with a 9.6% CAGR, driven by large-scale integration of bio-herbicides and green lubricants in Shandong and Hebei production zones.

- India, expanding at 8.9% CAGR, is deploying pelargonic acid in crop desiccants, organic herbicides, and textile cleaning agents, validated through ICAR field trials.

Together, these economies are shaping the global supply base for sustainable agrochemical intermediates.

Europe: Regulatory Leadership and Industrial Refinement

Europe remains the largest consumer region, backed by the EU Green Deal and policy reforms restricting legacy herbicides.

- Germany (8.2% CAGR) leads European expansion through adoption in eco-solvents and corrosion inhibitors.

- France (7.5%) and the U.K. (6.7%) show strong demand in municipal landscaping, coatings, and plasticizer applications.

High environmental standards have promoted domestic bio-refinery investments and formulation precision, ensuring sustained regional growth.

United States: From Regulation to Commercial Maturity

The U.S. market, growing at 6.0% CAGR, is transitioning from pilot-scale adoption to mainstream commercialization.

Bio-based pelargonic acid formulations are gaining traction in organic farming systems and industrial degreasers. Label expansions approved by the USDA have enabled use across row crops, orchards, and vineyards, making pelargonic acid a reliable bridge between compliance and performance.

Saudi Arabia: Emerging Hub for Bio-Industrial Chemistry

Under Vision 2030, Saudi Arabia is fostering domestic chemical diversification.

Pelargonic acid adoption is expanding across LNG, petrochemical, and lubricant sectors, supported by energy-efficiency and sustainability mandates.

Government-led R&D initiatives and incentives for bio-derived industrial inputs are establishing the kingdom as a regional production and distribution hub for sustainable chemicals.

Need tailored insights? Request report customization to match your specific business objectives: https://www.futuremarketinsights.com/customization-available/rep-gb-23094

Cross-Sector Adoption and Formulation Trends

FMI notes that 40% of total demand stems from agrochemical applications, while 25% comes from specialty chemical uses such as coatings and corrosion inhibitors.

Personal care and cosmetics contribute 15%, leveraging pelargonic acid as a natural antimicrobial and preservative, whereas industrial cleaning and food preservation account for the remaining share.

Recent trends include:

- Green derivatives such as pelargonate esters (+14.8% CAGR) used in high-humidity herbicide formulations.

- Smart ingredient tracing systems in 34% of cosmetic procurement chains for origin and purity validation.

- Feedstock innovation, integrating high-oleic vegetable oils to reduce carbon intensity and cost volatility.

- Formulation advances, including antioxidant-stabilized emulsions that extend shelf life by 18%.

Country-Level Growth Highlights

| Country | CAGR (2025–2035) | Growth Driver |

| China | 9.6% | Bio-herbicides & lubricant diversification |

| India | 8.9% | Sustainable agriculture & industrial additives |

| Germany | 8.2% | Eco-solvents & herbicide alternatives |

| U.K. | 6.7% | Turf management & bio-plasticizers |

| U.S.A. | 6.0% | Organic farming and bio-certified inputs |

These five economies collectively account for over 55% of global incremental growth, reflecting broad-based industrial realignment toward biological chemistry and green compliance.

Market Drivers and Strategic Outlook

- Sustainability Mandates: Regulatory agencies worldwide are prioritizing biodegradable herbicides and low-VOC industrial inputs.

2. Technological Advancements: Continuous improvements in synthesis efficiency and encapsulated slow-release formulations enhance field performance.

3. Cross-Industry Compatibility: Applicability across agrochemicals, lubricants, cosmetics, and cleaning systems ensures diversified demand.

4. Resilience Through Innovation: Manufacturers are investing in bio-based solvent integration and feedstock traceability, reinforcing long-term supply stability.

FMI forecasts that by 2035, bio-derived pelargonic acid will become a mainstream chemical intermediate, supporting circular economy objectives and replacing multiple petrochemical inputs across industries.

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Why Choose FMI: Empowering Decisions that Drive Real-World Outcomes: https://www.futuremarketinsights.com/why-fmi