Future Market Insights (FMI) projects the global Organophosphate Insecticides Market to expand from USD 8.9 billion in 2025 to USD 14.8 billion by 2035, at a CAGR of 5.2%. This growth trajectory underscores a global reliance on broad-spectrum pest management amid rising pest resistance, expanding cultivation acreage, and food security priorities across key agricultural economies.

The market will add USD 5.9 billion in new value over the decade, with 44% of gains realized by 2030 and the remaining 56% accruing through 2035—a balanced yet back-loaded opportunity driven by sustained agrochemical use and emerging applications in stored-grain protection.

Data Snapshot

| Metric | Value |

| Market Size (2025E) | USD 8.9 Billion |

| Market Size (2035F) | USD 14.8 Billion |

| CAGR (2025–2035) | 5.2% |

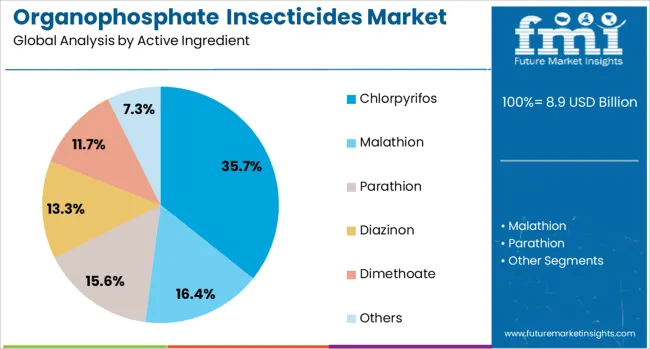

| Leading Ingredient | Chlorpyrifos (35.7% Share) |

| Agricultural Application Share | 72.3% |

| Key Growth Regions | APAC, Europe, USA, Saudi Arabia |

| Share of Global Agrochemicals Market | 10–12% |

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates: https://www.futuremarketinsights.com/reports/sample/rep-gb-23028

Agricultural Dominance and Chlorpyrifos Leadership

The agricultural sector will retain a commanding 72.3% share of global organophosphate consumption in 2025. Adoption remains concentrated in cereal, fruit, and vegetable crops, where farmers favor cost-effective and fast-acting solutions for yield protection.

Chlorpyrifos, accounting for 35.7% of revenues, remains the leading active ingredient owing to its broad-spectrum efficacy, affordability, and integration in pest-resistance management programs. Its continued usage across large-scale farms highlights both its resilience and adaptability despite regulatory headwinds in certain markets.

Regional Insights: APAC, Europe, USA, and Saudi Arabia Propel Growth

Asia-Pacific: High-Intensity Adoption and Production Scaling

The APAC region—led by China (7.0% CAGR) and India (6.5% CAGR)—is expected to account for the majority of global volume gains through 2035.

- China: Growth stems from heavy use in rice and vegetable cultivation and strong government backing for agrochemical innovation. Vertically integrated manufacturers ensure stable domestic supply and export flow to Southeast Asia.

- India: Public health vector-control programs and agricultural pest management are expanding. National initiatives deploying malathion ULV sprays boosted demand by 32% YoY in 2025, reducing vector densities by up to 25%.

Southeast Asian nations—Indonesia, Thailand, and the Philippines—also recorded 35% annual capacity increases in generic organophosphate production, improving affordability and rural access.

Europe: Regulated Yet Resilient Demand

While Europe enforces stricter pesticide policies, selective exemptions and precision-application technologies maintain relevance for organophosphates.

- Germany (6.0% CAGR): Controlled greenhouse usage and sustainable delivery systems sustain cautious but steady imports.

- France (5.5% CAGR): Horticultural demand continues amid pest outbreaks in vineyards and cereals.

- United Kingdom (4.9% CAGR): Dual-mode formulations—combining organophosphates with pyrethroids—are gaining ground for climate-induced pest resurgence.

These markets demonstrate a transition toward low-residue, encapsulated formulations aligning with EU sustainability standards.

United States: Targeted Applications Sustain Market Value

In the United States, the market will grow at 4.4% CAGR through 2035. Despite tightening EPA regulations, organophosphates remain integral to corn, citrus, sugarcane, and turfgrass applications. Innovation in microencapsulation and precision spraying supports continued commercial viability.

Emerging technologies such as smart-delivery capsules have improved environmental safety and dose efficiency, reaffirming organophosphates’ relevance in integrated pest-management systems.

Saudi Arabia: Controlled Expansion Under Vision 2030

In the Middle East, Saudi Arabia is emerging as a regional hub for agrochemical diversification under Vision 2030. Increasing investments in local pesticide formulation plants and controlled vector-management programs are propelling demand. Favorable regulatory frameworks for safe-handling insecticides and a focus on food self-sufficiency are expected to reinforce long-term consumption.

Market Dynamics: Drivers, Challenges, and Technological Progress

Key Growth Drivers

- Rising Pest Resistance: Escalating resistance to pyrethroids is fueling reliance on organophosphates in rotational pest-control systems.

- Food Security Initiatives: Expanding crop acreage and productivity mandates in developing economies sustain demand.

- Vector-Control Programs: Increasing deployment in public-health campaigns targeting mosquito-borne diseases.

- Cost-Efficiency and Broad Efficacy: Critical for large-scale cereal and fruit farming where affordability and yield preservation are paramount.

- Innovation in Formulation: Advances in encapsulation and drone-based precision spraying are reducing environmental impact while maintaining potency.

Challenges and Regulatory Pressures

Toxicological scrutiny across North America and Europe is prompting formulation reformulation and gradual phase-outs of legacy actives. Producers are investing in biodegradable carriers, low-dose emulsions, and smart application technologies to comply with emerging safety standards.

Trends Shaping the Next Decade

- Hybrid Formulations: Dual-mode blends (organophosphate + pyrethroid) reduce application frequency by ~18%.

- Localized Manufacturing: Southeast Asian and African manufacturers scaling low-cost production to serve smallholders.

- Integrated Pest Management (IPM): Wider adoption of organophosphates as transitional tools within IPM frameworks.

Country-Level Highlights

| Country | CAGR (2025–2035) | Key Insights |

| China | 7.0% | High domestic demand, export growth to ASEAN, R&D in low-residue formulations |

| India | 6.5% | Monsoon-season pest control, strong vector-control procurement |

| Germany | 6.0% | Controlled usage in greenhouses; sustainability trials in viticulture |

| UK | 4.9% | Adoption of reduced-dose, climate-adaptive spraying regimes |

| USA | 4.4% | Targeted field applications; innovation in encapsulated insecticides |

Market Outlook and Competitive Landscape

According to FMI’s assessment, the Organophosphate Insecticides Market constitutes 22–25% of total insecticide demand and 10–12% of global agrochemical value. Despite regional restrictions, demand is resilient due to reliability, affordability, and broad-spectrum performance.

Leading manufacturers are focusing on precision chemistry, safer handling, and sustainability alignment. Key priorities include:

- Enhanced bioavailability and efficacy through smart chelation.

- Encapsulation technology for reduced drift and residue.

- Backward integration ensuring raw-material traceability.

The landscape remains moderately consolidated, with producers balancing cost efficiency and compliance innovation to retain competitiveness across diverse agricultural systems.

FMI Perspective

“Organophosphate insecticides remain a critical backbone of global pest management strategies, particularly in high-intensity farming zones across Asia and emerging markets,” said an FMI spokesperson. “The next decade will define a transition toward safer, smarter, and more sustainable formulations that retain efficacy while meeting evolving regulatory and environmental standards.”

By 2035, the market’s USD 14.8 billion valuation will reflect both sustained agricultural reliance and technological modernization in agrochemistry—anchored by innovation, compliance, and regional adaptation.

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Why Choose FMI: Empowering Decisions that Drive Real-World Outcomes: https://www.futuremarketinsights.com/why-fmi