According to Future Market Insights (FMI), the global cyclic crude intermediate and gum market is projected to grow from USD 46.2 billion in 2025 to USD 72.5 billion by 2035, registering a steady CAGR of 4.6% during the forecast period. The industry’s expansion is anchored in the rising consumption of specialty chemicals across pharmaceutical, construction, coatings, packaging, and automotive applications.

Year-on-year (YoY) analysis reveals consistent growth of 4.5% – 5.0%, underscoring resilient industrial demand. By 2030, the market is anticipated to reach USD 55.3 billion, fueled by advancements in extraction technologies, specialty resin production, and bio-based chemical innovation.

Market Overview: Specialty Chemistry Underpins Industrial Growth

Cyclic crude intermediates and gums form a crucial sub-segment within the USD 800 billion global petrochemical and specialty chemicals industry. These materials contribute roughly 7 – 10% of the parent market, supplying critical inputs for adhesives, resins, sealants, and elastomers.

Their applications span cycloalkane synthesis, polymer stabilization, and functional material modification, serving industries focused on performance durability, purity, and process traceability.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates: https://www.futuremarketinsights.com/reports/sample/rep-gb-23159

Key Market Highlights (FMI 2025–2035)

| Metric | 2025 | 2035 | CAGR (%) |

| Global Market Value | USD 46.2 Billion | USD 72.5 Billion | 4.6 |

| Leading Product Type | Cyclic Crude – 26% Share | ||

| Top Application | Pharmaceuticals – 28% Share | ||

| Primary End Use | Pharmaceutical Industry – 27% Share | ||

| Leading Growth Regions | APAC, Europe, USA, Saudi Arabia |

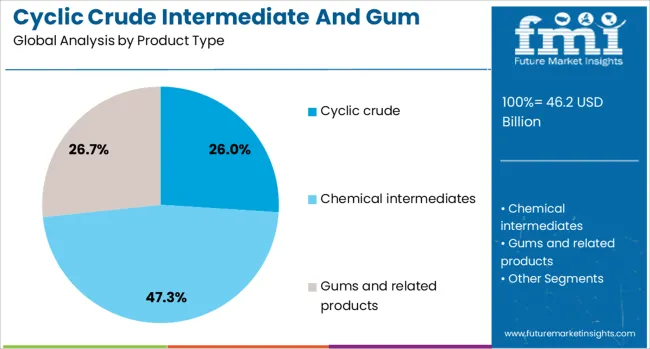

Product Insights: Cyclic Crude Leads with 26% Market Share

The cyclic crude segment commands 26% of total revenue in 2025, maintaining leadership through 2035. Its strength lies in chemical versatility and molecular stability, enabling precise manipulation during synthesis of high-value intermediates used in pharmaceuticals, agrochemicals, and performance materials.

As industrial clients pursue traceable raw materials and consistent purity standards, demand for cyclic crude remains robust. Its compatibility with automated refining and purification systems enhances scalability and cost-efficiency.

Application Insights: Pharmaceuticals Anchor Market Demand

The pharmaceuticals segment, representing 28% of global revenue in 2025, emerges as the leading application area. Growth is supported by rising production of active pharmaceutical ingredients (APIs) and bio-based excipients.

Cyclic intermediates improve bioavailability, controlled release, and formulation stability, making them indispensable in drug delivery and excipient design. Regulatory encouragement for clean-label and high-purity compounds further supports this segment’s leadership.

End-Use Insights: Pharmaceutical Industry Holds 27% Share

The pharmaceutical industry continues as the primary end-use segment, accounting for 27% of market share in 2025. The industry’s transition toward complex generics, biologics, and precision formulations drives the need for high-grade cyclic intermediates and functional gums.

FMI notes that this end-use is reinforced by stringent quality mandates and supply-chain integration efforts across emerging economies aiming to expand domestic drug manufacturing.

Regional Analysis: Global Synergy in Specialty Chemical Expansion

Asia–Pacific (APAC): Global Growth Hub

APAC dominates with over 40% market share, led by China (6.2% CAGR) and India (5.8%).

- China’s leadership stems from large-scale production of adhesives, resins, and sealants, supported by chemical parks and integrated industrial clusters.

- India’s growth reflects surging demand in construction, textiles, and packaging, enhanced by government-backed cluster development and infrastructure investments.

Collectively, APAC’s market leadership is driven by low-cost feedstock availability, technology upgrades, and rapid industrialization.

Europe: Specialty and Sustainability Leadership

Europe shows steady expansion, spearheaded by Germany (5.3%), France (4.8%), and the UK (4.4%).

- Germany focuses on precision chemical engineering and eco-compliant formulations.

- France leverages its expertise in medical packaging and specialty resins.

- The UK advances through R&D collaborations enhancing purity and safety compliance.

European manufacturers continue to pioneer low-VOC and recyclable chemistries, reinforcing regional alignment with EU Green Deal objectives.

USA: Industrial Maturity and Process Optimization

The United States, growing at 3.9% CAGR, remains a mature yet dynamic market. Adoption of advanced filtration and blending systems ensures product uniformity and high-grade performance across automotive, coatings, and flexible packaging industries.

Supply-chain optimization and regional distribution networks have reduced lead times and enhanced domestic supply resilience—supporting the ongoing transition toward sustainable intermediates and digitalized manufacturing.

Saudi Arabia: Vision 2030 Accelerates Chemical Diversification

Under Vision 2030, Saudi Arabia is fostering industrial diversification through investment in chemical intermediates and specialty materials.

- Expansion of integrated chemical clusters and gulf-region feedstock availability enables competitive manufacturing.

- Sustainability initiatives promote bio-based gum extraction and clean refining technologies.

These developments position the Kingdom as a strategic growth center within the Middle East’s specialty chemical landscape, reinforcing regional self-sufficiency and export capacity.

Market Drivers and Trends

- Rising Demand in Specialty Chemicals and Pharmaceuticals

Industrial diversification and increased R&D in high-purity cyclic compounds drive sustained demand from pharma and chemical industries. - Technological Innovation and Automation

Automation and robotics enhance production efficiency by ~30%, improve safety, and minimize manual intervention. Digitalized process control ensures higher yields and compliance with environmental standards. - Sustainability and Circular Feedstocks

Growing emphasis on green chemistry, renewable raw materials, and low-impact processes accelerates adoption across all major markets. Manufacturers investing in circular feedstock utilization gain a competitive edge. - Regulatory Compliance and Quality Assurance

Stringent environmental and safety mandates continue to shape production. FMI highlights that eco-certified and traceable inputs are now key selection criteria for global industrial buyers.

Country-Level Growth Snapshot (CAGR 2025–2035)

| Country | CAGR (%) | Key Growth Factor |

| China | 6.2 | Chemical manufacturing, resin output, export competitiveness |

| India | 5.8 | Infrastructure growth, cluster programs, packaging demand |

| Germany | 5.3 | Specialty chemicals, eco-compliance |

| UK | 4.4 | R&D partnerships, tailored formulations |

| USA | 3.9 | Industrial automation, stable demand base |

Market Outlook: A Decade of Sustainable Chemistry

Looking ahead, FMI projects a steady 4.6% CAGR through 2035, with continuous advances in bio-based intermediates, digital production systems, and smart material design.

As global industries prioritize safety, traceability, and low-carbon operations, cyclic crude intermediates and gums will play a pivotal role in the transition toward sustainable industrial chemistry.

Manufacturers aligning with ESG frameworks, automation efficiency, and renewable feedstocks are expected to lead the next growth phase.

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Why Choose FMI: Empowering Decisions that Drive Real-World Outcomes: https://www.futuremarketinsights.com/why-fmi