The global cold cuts market is entering a period of robust expansion on the back of evolving consumer lifestyles, rapid urbanization, and a strong shift toward ready-to-eat protein products. Valued at nearly USD 525 billion in 2024, the market is projected to reach USD 567.3 billion in 2025 and further accelerate to USD 1,336.1 billion by 2035, representing a CAGR of 8.5% (2025-2035).

A surge in demand for convenient, nutritious, and protein-rich meals—particularly among millennial and working populations—is reshaping the industry. Growing adoption of innovative packaging technologies such as vacuum sealing and modified atmosphere packaging (MAP) has enhanced product shelf life, extending fresh consumption windows and driving higher sales volumes globally.

To Explore Detailed Market Data, Segment-Wise Forecasts, and Competitive Insights, Request Sample Report! https://www.futuremarketinsights.com/reports/sample/rep-gb-16684

Healthier Cold Cuts Gain Traction Amid Premiumization Trend

Product innovation remains a core growth engine. Manufacturers are prioritizing low-fat, reduced-sodium, organic, and antibiotic-free cold cuts, expanding appeal among health-centered consumers. Enhanced slicing, precision marination, and automated packaging systems are enabling brands to offer premium, gourmet, and artisanal varieties.

Leading producers investing heavily: Hormel Foods Corporation, Tyson Foods, Smithfield Foods (WH Group), Cargill, and Conagra Brands are enhancing R&D, sustainability models, and strategic acquisitions to scale diversified product portfolios.

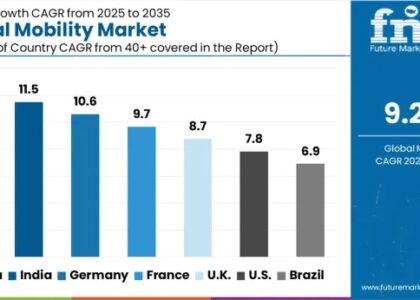

Regional Dynamics: Developed Economies Lead, Emerging Markets Accelerate

Consumption patterns vary based on economic growth, dietary evolution, and cultural preferences. Mature markets such as the United States, Canada, Germany, France, Italy, and the U.K. maintain high per capita consumption, fueled by busy lifestyles and deeply established meat processing industries. Meanwhile, China, India, Brazil, Mexico, and Argentina are witnessing rising adoption as disposable incomes rise and westernized diets penetrate retail shelves.

Market Propulsion: Non-Sliced and Chicken Cold Cuts Dominate

Research indicates notable momentum within two key segments reshaping consumption patterns:

🔹 Non-Sliced Cold Cuts (46% market share in 2025)

- Greater perception of freshness and natural flavor

- Higher utilization in commercial kitchens and foodservice

- Supported by advanced freshness-preserving packaging

- Preferred across a wider meal spectrum—sandwiches to main dishes

🔹 Chicken Cold Cuts (43.4% market share by 2025)

- Lower fat content compared to beef and pork

- Affordable, high-protein options with broad global cultural acceptance

- Expanding portfolio of organic, flavored, and antibiotic-free varieties

- Rising popularity across quick-service restaurants, retail, and catering sectors

Purchasing Trends and Opportunities

Consumers and industry buyers are shaping the market in three major ways:

- Retail preferences: sliced, low-sodium, nitrate-free, and artisanal deli meats

- Foodservice demand: bulk, cost-effective supplies for delis, convenience chains, and catering

- Premiumization & clean labels: organic, grass-fed, minimal additives, plant-based cold cuts

With charcuterie boards trending worldwide, gourmet dry-cured meats and region-specific flavors are carving out new growth lanes for producers, especially in Europe and Australia.

Risk Outlook: Transparency & Sustainable Sourcing Take Center Stage

The cold cuts industry faces reputational and regulatory scrutiny over links to processed meat-related health risks. Additionally, fluctuating livestock and raw material costs—coupled with supply chain pressures—pose operational challenges. Manufacturers are turning to:

- Multi-sourcing models for ingredients

- Plant-based and hybrid cold cuts to address dietary shifts

- Sustainable meat sourcing & eco-conscious packaging to reduce environmental impact

Competitive Landscape: Global Giants and Regional Specialists

Multinational leaders Tyson Foods, JBS S.A., Cargill, Hormel Foods, and Smithfield Foods (WH Group) dominate through vertical integration, supply chain efficiency, and premium portfolio expansion. Meanwhile, regional specialists like Maple Leaf Foods, Kraft Heinz (Oscar Mayer), Seaboard Corporation, Bar-S Foods, and OSI Group compete strategically with both branded and private-label offerings.

Strategic investments in long-shelf-life packaging, responsible sourcing, and gourmet expansion are expected to remain competitive differentiators over the next decade.

Conclusion

With changing lifestyles, rapid urbanization, and a strong preference for convenient protein formats, the cold cuts market is set for historic growth. The fusion of health-centric innovation, premiumization, and sustainability will determine the industry’s leaders in the coming decade.