A Billion-Dollar Spice Built on Fragile Ground

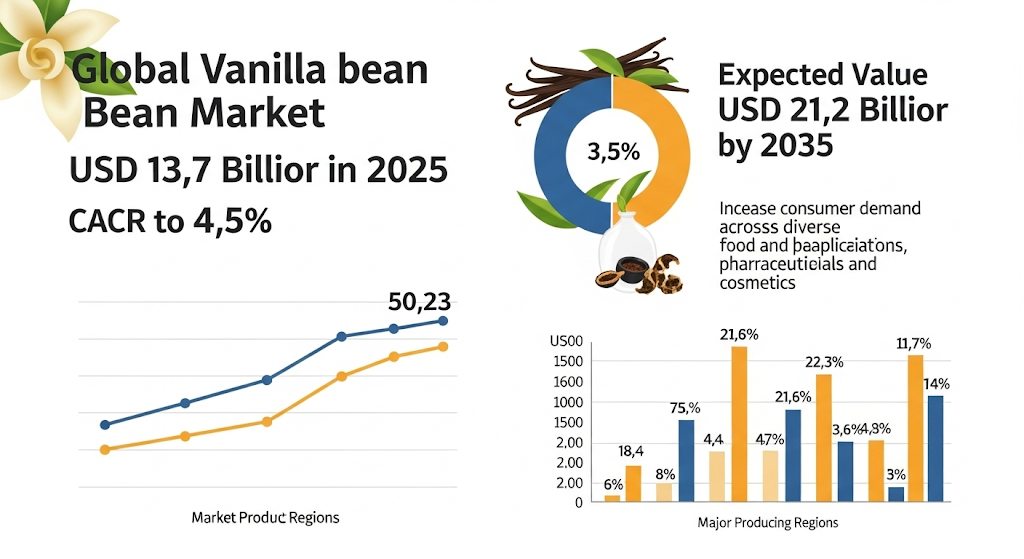

The global vanilla bean market is heating up—and not just in kitchens. According to Future Market Insights (FMI), the industry was valued at USD 13.7 billion in 2025 and is projected to reach USD 21.2 billion by 2035, growing at a CAGR of 4.5%. This upward curve is powered by soaring demand for natural flavoring, plant-based ingredients, and clean-label products—especially in gourmet food, cosmetics, and pharmaceuticals.

Yet while the market rises, its foundation remains precarious. A majority of global vanilla still comes from a single region—Madagascar—leaving supply chains deeply vulnerable to climate disruption, poor infrastructure, and labor issues. The result: high prices, inconsistent quality, and an ethical shadow looming over one of the world’s most beloved ingredients.

Access Key Market Insights: Request a Sample Report Now: https://www.futuremarketinsights.com/reports/sample/rep-gb-8558

Why Madagascar Matters—and Why It’s Struggling

Future Market Insights notes that Madagascar remains the heart of vanilla cultivation, producing over 80% of the world’s supply. This concentration has created both dominance and fragility. The country faces seasonal storms, crop theft, and quality control issues, all of which drive volatility in price and availability. FMI warns that such risks have pushed buyers to explore new sources like Indonesia and Uganda—but these efforts remain fledgling and fragmented.

In addition to environmental unpredictability, the report highlights increasing market pressure on producers to meet demand for organic and sustainably grown beans—without necessarily offering the infrastructure or incentives to support those goals.

Interest in Market Trends: Get Detailed Analysis and Insights with Our Comprehensive Report: https://www.futuremarketinsights.com/reports/vanilla-bean-market

Climate Pressures Are Quietly Mounting

FMI’s analysis also underscores the climate sensitivity of vanilla cultivation. The plant is notoriously finicky, requiring hand pollination and precise growing conditions. A single cyclone or drought season in Madagascar can wipe out an entire year’s harvest. As extreme weather events grow more frequent, supply chain resilience is becoming less a goal and more a necessity.

A Market Driven by Natural Demand—and Ethical Risk

What’s pushing the growth? According to FMI, it’s largely the surge in clean-label and natural ingredient preferences. Food and beverage manufacturers are replacing synthetic vanillin with real vanilla extract. Cosmetics and wellness brands are using the bean’s antioxidant properties in their formulations. Yet while consumer demand for authenticity grows, the ethical questions around sourcing remain murky.

FMI suggests that premium vanilla, especially the Bourbon variety, will continue to dominate, with Europe and North America leading the charge in consumption. But that dominance comes with a price—both literally and morally. Vanilla remains one of the most expensive spices in the world by weight, and many producers are paid a fraction of its final retail value.

What Needs to Change—Fast

If vanilla is to remain a sustainable global commodity, the market needs to confront some uncomfortable truths:

- Diversify Supply Chains – Relying almost entirely on Madagascar is unsustainable. Greater investment in alternative regions must be prioritized.

- Strengthen Resilience – Farmers need climate-adaptive training and tools to weather seasonal shocks.

- Support Ethical Sourcing – Traceability and fair compensation should be non-negotiable standards—not luxury marketing points.

- Build Local Infrastructure – Without drying stations, cooperatives, and fair trade mechanisms, even high demand won’t lift farmers out of instability.

Vanilla’s Fragile Future

Vanilla’s rise is undeniable—but so is its fragility. Future Market Insights paints a promising picture of growth and innovation. Yet numbers alone don’t tell the whole story.

We’re staring at a market with billion-dollar potential built on an unstable spine: climate-sensitive crops, under-supported farmers, and extreme geographic concentration. If the industry doesn’t address its foundational weaknesses now, it won’t just face price hikes or shortages—it will risk collapse.

Vanilla may be sweet, but unless we treat its roots with care, the future could taste much more bitter.

Leading Vanilla Bean Brands

- Symrise AG

- Eurovanille

- Takasago International Corp.

- Synergy Flavors Inc.

- Archer Daniels Midland Co.

- Venui Vanilla

- Nielsen-Massey Vanillas Inc.

- Tharakan and Company

- Lemur International Inc.

- Apex Flavors Inc.

- Others

Explore Functional Food Ingredients Industry Analysis: https://www.futuremarketinsights.com/industry-analysis/functional-food-ingredients

Explore Functional Food Ingredients Industry Analysis: https://www.futuremarketinsights.com/industry-analysis/functional-food-ingredients

Key Segments of the Report

By Nature:

This segment is further categorized into Organic and Conventional.

By Form:

This segment is further categorized into Whole and Extract.

By Product Variety:

This segment is further categorized into Indonesian, Madagascar, Mexican, Ugandan, Tahitian and Others.

By Distribution Channel:

This segment is further categorized into Direct, Online Retailer, Specialty Store, Supermaret/Hypermarket and Wholesaler.

By Region:

Industry analysis has been carried out in key countries of North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus and the Middle East & Africa.