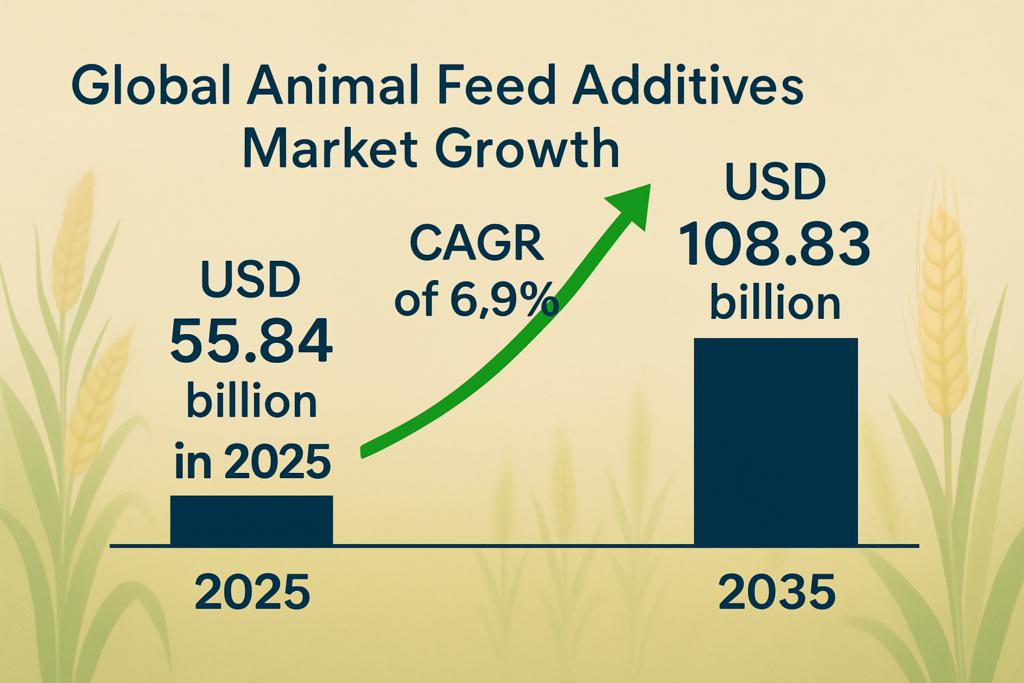

The global animal feed additives market is poised for substantial growth, projected to rise from USD 55.84 billion in 2025 to USD 108.83 billion by 2035, reflecting a CAGR of 6.9%. This expansion is fueled by increasing demand for safe, high-performance animal nutrition solutions, amid growing concerns around animal health, disease resistance, and sustainable livestock productivity. Technological advancements in enzymes, probiotics, and synthetic amino acids are revolutionizing feed efficiency and supporting stricter animal welfare and environmental standards.

Track Evolving Market Trends: Request Your Sample Report: https://www.futuremarketinsights.com/reports/sample/rep-gb-418

Market Trends Highlighted

- Innovation in Gut Health Solutions: Rising popularity of probiotics, prebiotics, and postbiotics, especially in North America and Asia.

- Precision Nutrition & Fermentation Technology: Tailored additive solutions using AI-driven diagnostics and fermentation-based amino acid production.

- Sustainability Focus: Additives reducing nitrogen excretion and improving feed conversion ratios to align with environmental regulations.

Enhanced Interest in Market Trends: Access In-Depth Analysis and Insights with Our Full Report: https://www.futuremarketinsights.com/reports/animal-feed-additives-market

Recent Developments

- China: Accelerated domestic production of synthetic amino acids via fermentation to reduce import reliance.

- USA: Cargill and ADM are investing in postbiotic technologies tailored for specific livestock needs.

- Brazil: Major companies focus on mycotoxin mitigation using enzymatic detoxifiers and biotransformation agents.

- Global Players: Companies like DSM-Firmenich, Evonik, and Alltech are driving innovation in climate-resilient and contamination-controlled feed additives.

Key Takeaways of the Report

- The animal feed additives market will nearly double in value by 2035.

- Enzymes, probiotics, and amino acids remain dominant additive categories.

- AI and postbiotic innovations are emerging as key technological differentiators.

- Environmental pressures and animal health mandates are accelerating product evolution.

- Regional priorities—gut health in the US, cost-efficiency in China, and feed safety in Brazil—are shaping localized strategies.

Market Drivers

- Growing Demand for Safe and Nutritious Feed: Rising global meat and dairy consumption is fueling demand for additives that enhance nutrient absorption and animal immunity.

- Regulatory Shifts: Global restrictions on antibiotic growth promoters are increasing reliance on alternative gut health additives.

- Technological Advancements: Innovations in postbiotics, AI-driven diagnostics, and fermentation techniques are unlocking new market opportunities.

- Environmental Sustainability: Pressure to reduce nitrogen excretion and improve feed efficiency supports adoption of eco-friendly additives.

Regional Insights

- Asia-Pacific: China leads with aggressive expansion in synthetic amino acid production, leveraging its large swine and poultry industries and investing in cost-efficient, precision nutrition.

- North America: The U.S. focuses on antibiotic alternatives with increased R&D in postbiotic and precision gut health solutions.

- Latin America: Brazil prioritizes feed safety and climate resilience through the integration of mycotoxin management and shelf-life-extending additives.

Country-wise CAGR Analysis (2025–2035)

| Country | CAGR (%) |

| China | 6.3% |

| United States | 3.8% |

| Brazil | 2.5% |

- China stands out with the highest growth rate, driven by increased production of synthetic amino acids (lysine, methionine, threonine), adoption of precision feeding, and local manufacturing investments.

- USA sees moderate growth through the replacement of AGPs with postbiotic solutions and AI-enabled diagnostics.

- Brazil’s focus remains on managing feed contamination and addressing climate-related challenges.

Competition Outlook

The animal feed additives market remains competitive with a mix of multinational corporations and regional players.

Leading companies include:

- Cargill Inc.

- BASF SE

- Archer Daniels Midland (ADM)

- Evonik Industries AG

- DSM Nutritional Products

- Nutreco N.V.

- Kemin Industries

- Novus International

- Alltech

- Adisseo

Explore Animal Nutrition Industry Analysis: https://www.futuremarketinsights.com/industry-analysis/animal-nutrition

Explore Animal Nutrition Industry Analysis: https://www.futuremarketinsights.com/industry-analysis/animal-nutrition

Key Segments

By Additive Type:

Technological Additives (Preservatives, Emulsifiers, and Others), Sensory Additives (Sweeteners, Lutein, and Others), Nutritional Additives

By Form:

Powder, Granules, Liquid

By Region:

Industry analysis has been carried out in key countries of North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, and Oceania