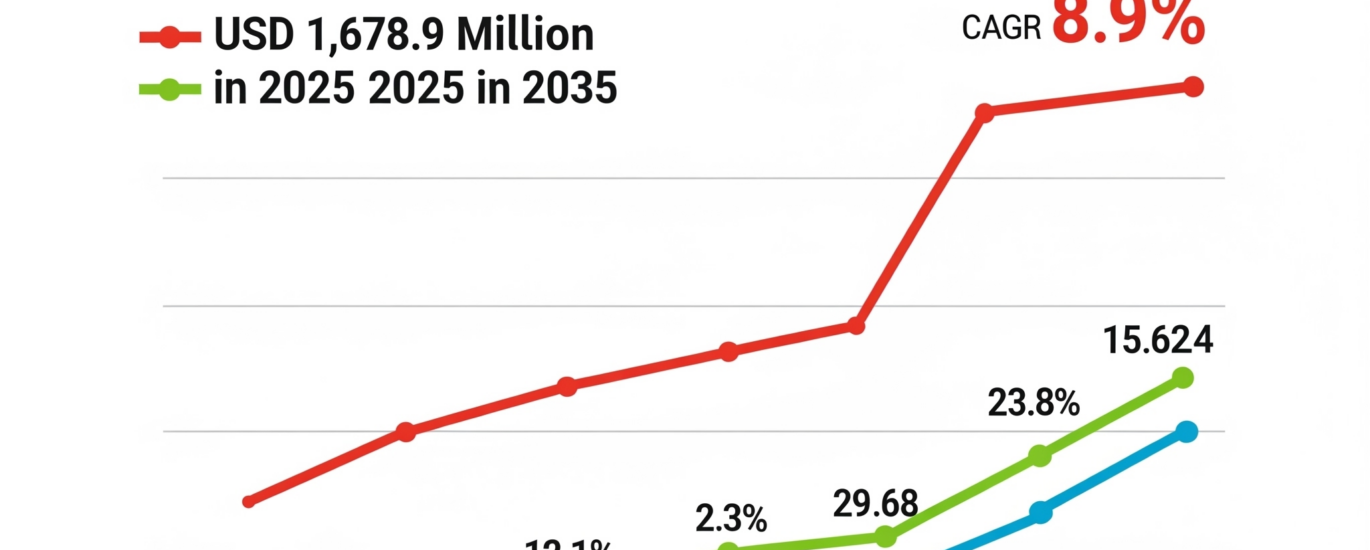

The global aircraft tube and duct assemblies market is anticipated to grow significantly, expanding from USD 1,678.9 million in 2025 to USD 3,938.3 million by 2035, at a CAGR of 8.9% during the forecast period. This upward trajectory is being powered by rising demand for lightweight, corrosion-resistant materials and the need to meet advanced performance specifications in modern aerospace platforms. As aircraft systems become more integrated and efficient, the role of tubes and duct assemblies in thermal regulation, hydraulic systems, air conditioning, and pressurized fuel transport is increasingly critical.

Aircraft manufacturers are placing higher emphasis on assemblies that combine aerodynamic efficiency, temperature resilience, and reduced weight—which are all vital for enhancing fuel efficiency and payload capacity. Additionally, the shift toward more electric and hybrid-electric aircraft architectures is driving the innovation of tubing solutions that can withstand both thermal and mechanical stresses in increasingly compact airframe environments.

Get Ahead with Our Report: Request Your Sample Now!

https://www.futuremarketinsights.com/reports/sample/rep-gb-3716

Market Trends

-

Rising use of titanium and high-performance alloys for superior strength-to-weight ratio.

-

Adoption of modular tubing systems for easier maintenance and replacement.

-

Increased focus on 3D printing and additive manufacturing for complex duct designs.

-

Growing implementation of noise and vibration suppression ducts.

-

Trend toward miniaturization to support compact aerospace systems.

Driving Forces Behind Market Growth

-

Surge in commercial aircraft production, especially narrow-body jets for short-haul travel.

-

Expansion of defense aviation budgets, particularly in the U.S., China, and India.

-

High demand for thermal management systems in electric aircraft platforms.

-

Greater focus on fuel efficiency and emissions reduction.

-

Rise in aftermarket retrofitting and modernization programs.

Challenges and Opportunities

-

Challenges:

-

Complex certification processes and compliance regulations.

-

High cost of advanced alloys and composite tubing materials.

-

Limited availability of skilled labor for custom tubing design and installation.

-

-

Opportunities:

-

Expansion in urban air mobility (UAM) and eVTOL aircraft markets.

-

Innovations in welded and seamless tube manufacturing.

-

Growth in aircraft maintenance, repair, and overhaul (MRO) services.

-

Rising investments in lightweight aerospace materials and hybrid propulsion systems.

-

Recent Industry Developments

-

PCC Aerostructures announced expansion of its tubing production facility in North America to support next-gen aircraft programs.

-

Senior Aerospace developed a new series of flexible ducting systems for thermal-critical environments in electric aircraft.

-

Leggett & Platt Aerospace invested in automated forming and brazing technologies to improve duct reliability and reduce weight.

-

Eaton Corporation expanded its global supply chain capabilities for aerospace tubing assemblies, focusing on Asia-Pacific markets.

Thorough Market Evaluation: Full Report

https://www.futuremarketinsights.com/reports/aircraft-tube-and-duct-assemblies-market

Regional Analysis

-

North America:

-

Leading market due to presence of major aircraft OEMs like Boeing, Lockheed Martin, and Raytheon.

-

Strong aftermarket activity and defense spending in the U.S. sustain continuous demand.

-

-

Europe:

-

Robust growth led by Airbus programs and increasing interest in green aviation technologies.

-

Rising demand for lightweight composite ducts in hybrid-electric aircraft initiatives.

-

-

Asia-Pacific:

-

Fastest-growing region due to expanding aircraft fleets in China, India, and Southeast Asia.

-

Regional players ramping up investments in domestic manufacturing and component integration.

-

-

Latin America & Middle East and Africa:

-

Moderate growth with increasing MRO activities and fleet modernization.

-

Investments in aerospace infrastructure driving local demand for tube and duct assemblies.

-