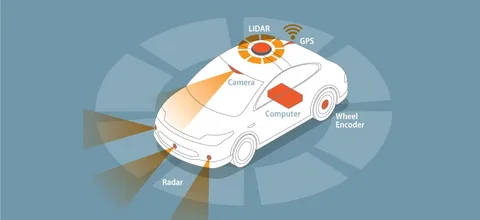

The Advanced Driver Assistance Systems (ADAS) sensors market is projected to grow from USD 36.07 billion in 2025 to USD 78.6 billion by 2035, expanding at a CAGR of 8.1% during the forecast period. This growth is largely attributed to the rapid integration of artificial intelligence (AI), breakthroughs in sensor fusion technologies, and the increasing deployment of high-performance radar and LiDAR platforms. These sensor innovations are at the core of evolving vehicle automation, empowering systems like adaptive cruise control, lane-keeping assist, automatic emergency braking, and blind spot detection.

Automakers and technology firms are doubling down on their investments in ADAS as regulatory authorities push for safer roads and fewer accidents. As vehicles move closer to Level 3 and Level 4 autonomy, the need for robust, real-time environmental sensing continues to surge. The demand is especially prominent across premium and electric vehicle (EV) segments, where automation and driver assistance are key selling points.

Get Ahead with Our Report: Request Your Sample Now!

https://www.futuremarketinsights.com/reports/sample/rep-gb-11865

Market Trends

-

Widespread adoption of radar, LiDAR, and ultrasonic sensors for 360° object detection.

-

Growing use of camera-based systems with AI-based object and lane recognition.

-

Rising integration of sensor fusion platforms for accurate environmental mapping.

-

Increasing demand for Level 2+ and Level 3 autonomous features in premium vehicles.

-

Expansion of cloud-based ADAS analytics for data-driven enhancements.

Driving Forces Behind Market Growth

-

Regulatory mandates pushing for collision avoidance systems and pedestrian detection.

-

Rise in road safety awareness and consumer preference for driver assistance features.

-

Integration of AI and deep learning algorithms to enhance detection accuracy.

-

Surge in EV and autonomous vehicle production, especially in China, Europe, and the U.S.

-

Partnerships between automotive OEMs and tech giants to develop next-gen ADAS.

Challenges and Opportunities

-

Challenges:

-

High development and integration costs for multi-sensor ADAS platforms.

-

Limited standardization across sensor technologies and vehicle models.

-

Concerns over sensor performance in adverse weather and lighting conditions.

-

-

Opportunities:

-

Growing deployment of ADAS in mid-range and entry-level vehicles.

-

Evolution of solid-state LiDAR for compact and affordable solutions.

-

Potential for over-the-air (OTA) updates to improve sensor algorithms post-sale.

-

Rising aftermarket demand for ADAS retrofitting in older vehicles.

-

Recent Industry Developments

-

Mobileye announced the launch of its next-gen EyeQ6 system-on-chip to enable scalable ADAS deployment across vehicle segments.

-

Velodyne Lidar and Ouster merged in 2024 to streamline LiDAR innovation and expand sensor supply to global OEMs.

-

Bosch unveiled a long-range radar with enhanced field-of-view for cross-traffic alerts and highway pilot systems.

-

Continental expanded its sensor production capacity in Asia to meet rising demand from EV and autonomous car manufacturers.

Thorough Market Evaluation: Full Report

https://www.futuremarketinsights.com/reports/adas-sensors-market

Regional Analysis

-

North America:

-

Dominated by strong presence of tech-led automotive innovation and regulatory backing.

-

High adoption of ADAS in SUVs, trucks, and luxury vehicles.

-

Key growth in the U.S. and Canada driven by government crash prevention mandates.

-

-

Europe:

-

Leading region due to stringent vehicle safety standards and advanced automotive manufacturing.

-

Early adoption of Level 2+ ADAS in Germany, France, and the UK.

-

Increasing R&D in sensor fusion and V2X communication systems.

-

-

Asia-Pacific:

-

Fastest-growing region with large-scale EV production in China and Japan.

-

Government incentives and smart city infrastructure boosting demand.

-

Major automakers expanding local ADAS sensor production hubs.

-

-

Latin America & Middle East and Africa:

-

Gradual adoption due to rising consumer awareness and safety preferences.

-

Opportunities in aftermarket and commercial vehicle segments.

-